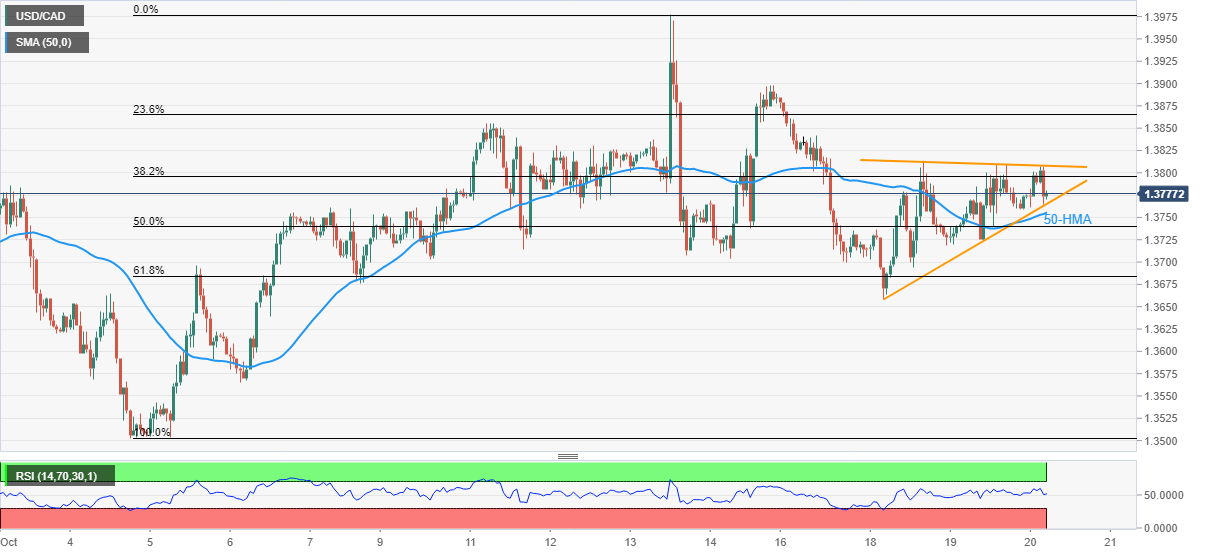

USD/CAD Price Analysis: Nearby triangle restricts bear’s entry above 1.3750

- USD/CAD pares intraday gains inside a three-day-old triangle formation.

- RSI conditions, 50-HMA add to the downside filters.

- Bulls need a successful break of 1.3800 for conviction.

USD/CAD grinds lower around 1.3770 during early Thursday morning in Europe, after a two-day uptrend, as traders await a clear break of immediate triangle support. In doing so, the Loonie pair portrays the market’s indecision.

Other than the three-day-old symmetrical triangle’s support line, the firmer RSI (14) also keeps the USD/CAD buyers hopeful.

Even if the quote drops below 1.3765 immediate support, it needs validation from the 50-HMA support of 1.3750 to convince the USD/CAD sellers.

In that case, the pair could quickly drop to the weekly low near 1.3655 before declining toward the monthly low surrounding the 1.3500 round figure.

Meanwhile, recovery moves need to cross the aforementioned triangle’s resistance line, around 1.3800 by the press time, to recall the USD/CAD buyers.

Following that, 1.3900 and the monthly high near 1.3980 could entertain the bulls before flashing the 1.4000 mark on the chart.

It’s worth noting that the USD/CAD pair’s successful run-up beyond 1.4000 won’t hesitate to aim for the May 2020 high near 1.4175.

To sum up, USD/CAD is likely to remain on the bull’s radar despite the latest inaction. However, a downside break of 1.3750 might trigger a short-term correction.

USD/CAD: Hourly chart

Trend: Bullish