Gold Price Forecast: XAU/USD bulls meet resistance and bears eye trendline support

- Gold price is firm in the open on a soft US Dollar.

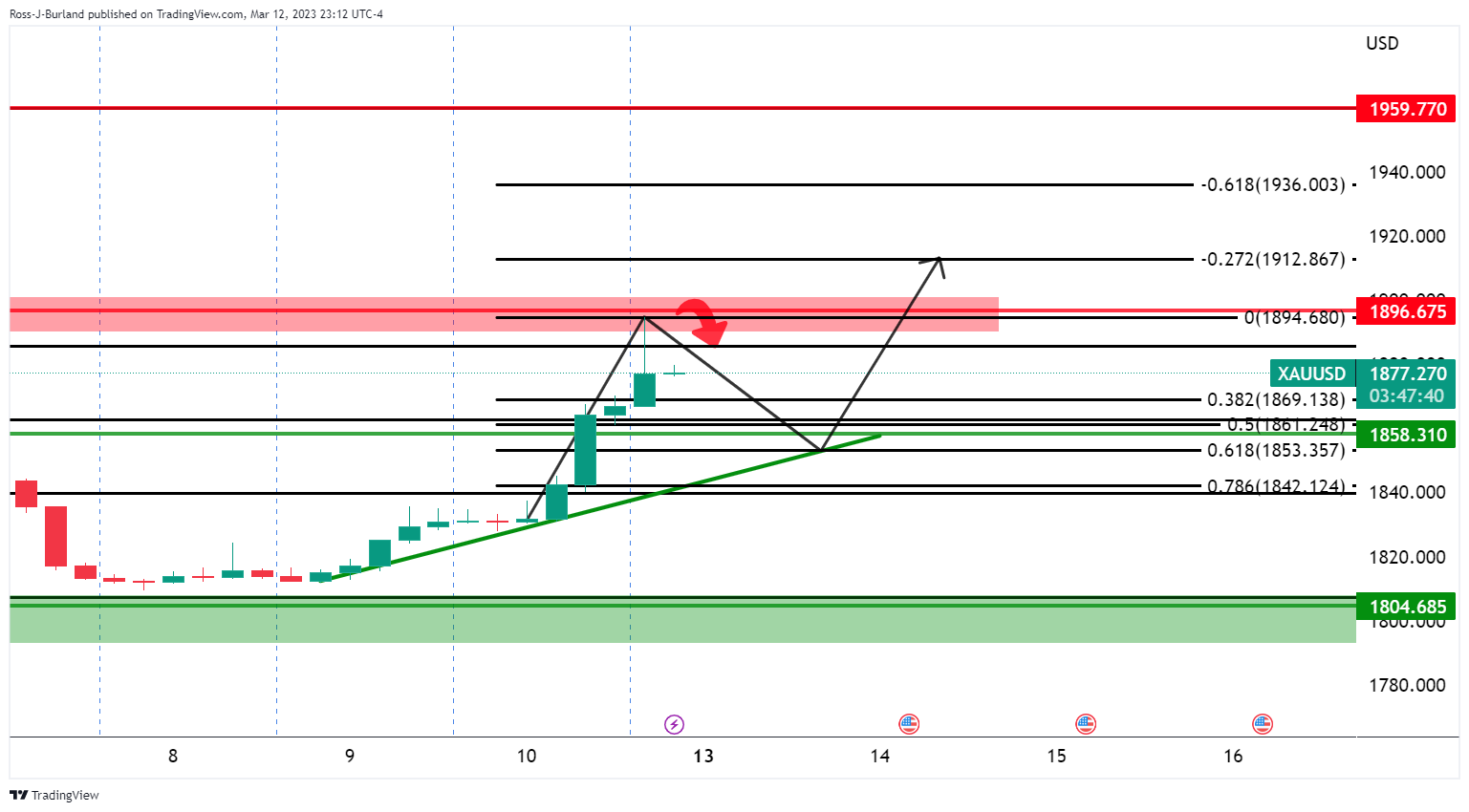

- Gold price bears eye trendline support while bulls look to $1,920s.

Gold price was higher at the start of the week by some 0.5% after the first hour of Tokyo trade having jumped 2% on Friday and while US authorities announced plans to limit the fallout from the collapse of Silicon Valley Bank (SVB). At the time of writing, Gold price is trading at $1,878 and between a low of $1,867.03 and $1,894.68.

In a joint statement, the US Treasury and Federal Reserve announced a range of measures to stabilise the banking system and said depositors at SVB would have access to their deposits on Monday. The Biden administration on Sunday guaranteed that customers of the failed Silicon Valley Bank will have access to all their money starting Monday. In a joint statement Sunday, Treasury Secretary Janet Yellen, Federal Reserve Chair Jerome Powell and Federal Deposit Insurance Corporation Chairman Martin J. Gruenberg said the FDIC will make SVB and Signature’s customers whole.

Investors speculated the Fed would now be reluctant to rock the boat by hiking interest rates by a super-sized 50 basis points this month which gave rise to a softer US Dollar. Fed fund futures surged in early trading to imply only a 17% chance of a half-point hike, compared to around 70% before the SVB news broke last week. The peak for rates came all the way back to 5.14%, from 5.69%, last Wednesday, and markets were even pricing in rate cuts by the end of the year. Yields on two-year Treasuries dropped to 4.445%, well below last week's 5.08% high and in a move that has benefitted the Gold price.

Meanwhile, traders will be looking at what the US Consumer Price Index figures will reveal on Tuesday. Even with the financial system under strain, there are prospects of a more aggressive Fed if the data comes in hot. ´´Core prices likely gained momentum in February with the index rising a strong 0.5% MoM, as we look for the recent large relief from goods deflation to start normalizing,´´ analysts at TD Securities explained. ´´Shelter inflation likely remained the key wildcard, while slowing gasoline and food prices will likely dent non-core CPI inflation. Our m/m forecasts imply 6.1%/5.5% YoY for total/core prices.´´

Gold technical analysis

- Gold, Chart of the Week: XAU/USD bulls could have some staying power

On the 4-hour timeframe there are prospects of a meanwhile correction into the Friday rally for the opening balance as follows:

The bears could be moving in at this juncture and a correction into the trendline support might result in a test of and failure for an onward bullish continuation with the $1,920s eyed.