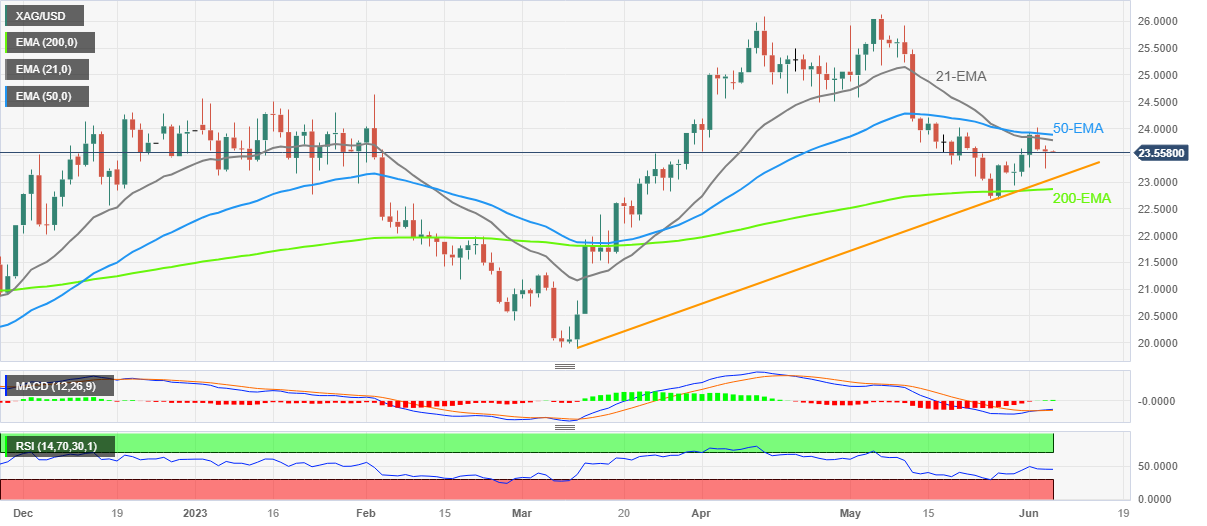

Silver Price Analysis: XAG/USD retreats from key EMA hurdles below $24.00

- Silver Price fades late Monday’s recovery as 21-EMA, 50-EMA prod bulls.

- MACD, RSI (14) line suggest further grinding towards the north.

- Three-month-old ascending trend line, 200-EMA restrict short-term downside.

Silver Price (XAU/USD) remains depressed near $23.55, fading the previous day’s corrective bounce off $23.25, amid early Tuesday.

In doing so, the bright metal registers a failure to cross the 21-day and 50-day Exponential Moving Averages (EMAs). However, the quote’s previous rebound from an upward-sloping support line from early March, as well as the 200-EMA, keeps the XAG/USD bears off the table.

That said, the bullish MACD signals and upbeat RSI (14) also suggest further grinding of the Silver Price towards the north.

With this, the Silver traders can expect a short-term downside towards the aforementioned three-month-old upward-sloping support line, close to $23.05, quickly followed by the $23.00 round figure. However, the 200-EMA level of around $22.85 can challenge the XAG/USD bears afterward.

In a case where the XAG/USD drops below $22.85, the previous monthly low of $22.70 appears the last defense of the Silver buyers.

On the contrary, the 21-EMA and 50-EMA restrict short-term upside of the Silver Price near $23.80 and $23.90 in that order.

Following that, the $24.00 round figure holds the key for the metal’s further upside towards late April’s swing low of around $24.50 and then toward the February month’s high of near $24.65.

Silver Price: Daily chart

Trend: Recovery expected