AUD/JPY Price Analysis: Tumbles amidst bearish signals, eyes support levels

- AUD/JPY sees a bearish trend below 96.00, with sellers eyeing the 95.00 figure.

- The AUD/JPY could potentially slide to the Tenkan-Sen line at 95.41.

- Upside resistance lies around 97.00 after the AUD/JPY surpasses key resistance levels.

As the Asian session began, the AUD/JPY exchanged hands at around 95.96, following Tuesday’s price action. The AUD/JPY formed a three-candle evening star chart pattern, which suggests further downside action is expected.

AUD/JPY Price Analysis: Technical outlook

From the daily chart perspective, the AUD/JPY remains upward biased in the medium term, but a back-to-back bearish session suggests downside action is warranted. If the AUD/JPY slides past the June 20 daily low of 95.57, that could drive the price toward the Tenkan-Sen line at 95.41. A breach of the latter could tumble the AUD/JPY below the 95.00 handle, exposing the 94.00 figure immediately followed by the Kijun-Sen line at 93.96.

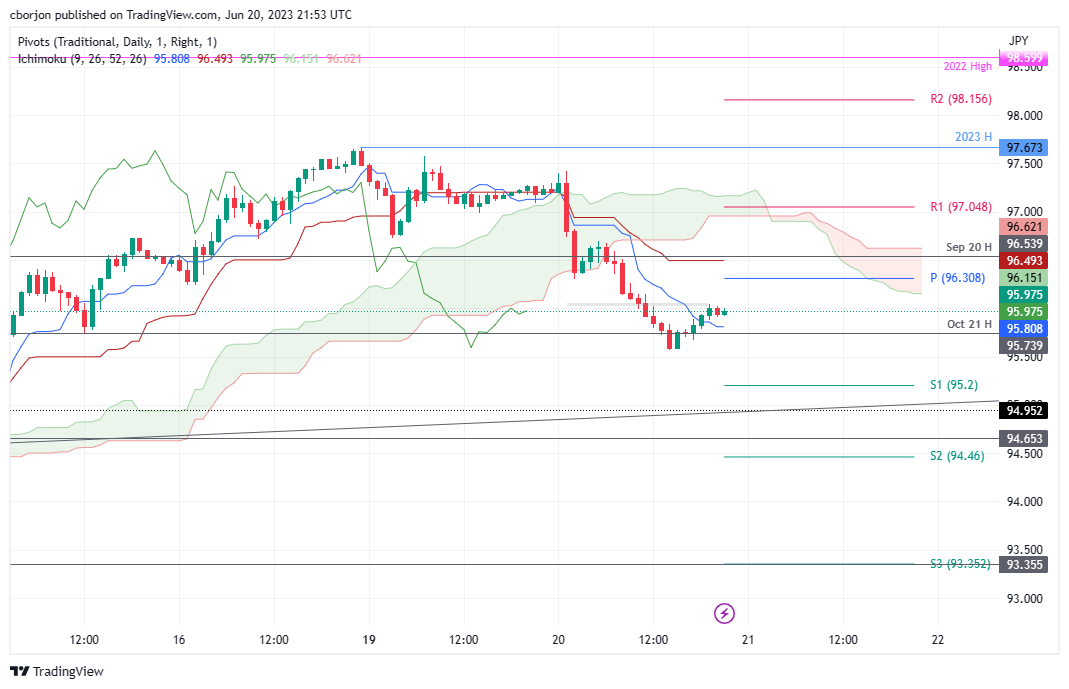

Dropping to the 1-hour chart, the AUD/JPY is set to extend its losses, but support lies at the Tenkan-Sen line at 95.80. Once cleared, the cross would test the 95.57 June 20 low before challenging the S1 daily pivot at 95.20, followed by the S2 pivot at 94.46.

Conversely, if AUD/JPY cracks the 96.00 figure, it would exacerbate a rally toward the bottom of the Ichimoku cloud. The next resistance would be the daily pivot at 96.30, followed by the Kijun-Sen line at 96.49, before testing the bottom of the cloud at around 97.00.

AUD/JPY Price Action – Hourly chart