EUR/USD flirting with highs near 1.0570 following Mnuchin

The now offered bias around the buck is now fuelling the current upside momentum around EUR/USD, testing fresh highs around 1.0570.

EUR/USD bid on USD-weakness

Spot met further buying pressure today after US Treasury Secretary Steve Mnuchin failed to give further details on the ‘phenomenal’ tax reform promised by President D.Trump last week. Mnuchin said the government is committed to a ‘very significant’ tax reform by the Congress recess in August.

On another direction, EUR stayed apathetic after ECB’s J.Weidmann said he did not support QE extension in December, while he stressed that the Bundesbank is not forecasting ECB rate decisions.

Earlier in the session, ECB’s E.Nowotny argued there is no need to change interest rates this year.

Next on tap in the US docket, Initial Claims and the Chicago National Activity Index are due along with the speech by Atlanta Fed D. Lockhart, who will retire on February 28.

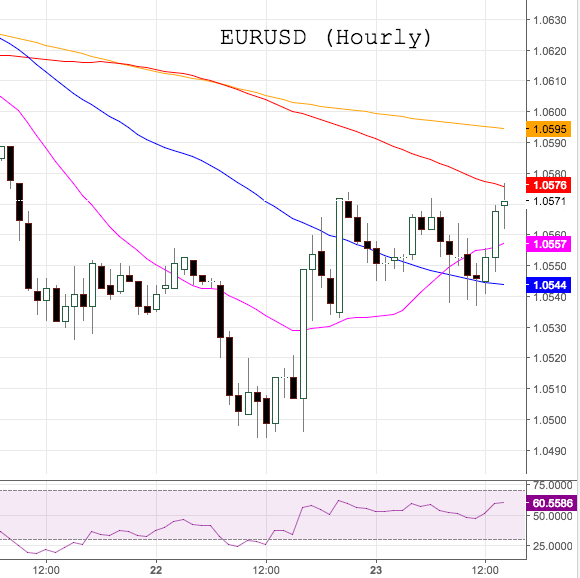

EUR/USD levels to watch

At the moment the pair is losing 0.06% at 1.0550 and a breach of 1.0498 (low Feb.22) would target 1.0452 (low Jan.11) en route to 1.0339 (2017 low Jan.3). On the upside, the next resistance lines up at 1.0593 (55-day sma) followed by 1.0682 (high Feb.16) and finally 1.0706 (38.2% Fibo of the November-January drop).