US Dollar turns positive around 89.70, US data eyed

- The index comes back after testing lows in the 89.60/55 band.

- US potential tariffs on China in the centre of the debate so far.

- US February’s Retail Sales next of relevance later in the NA session.

The greenback, in terms of the US Dollar Index (DXY), has managed to leave the area of session lows in the 89.60/55 band and is now posting marginal gains around 89.70.

US Dollar focused on data, Trump

The index is looking to regain some upside traction after three consecutive daily pullbacks.

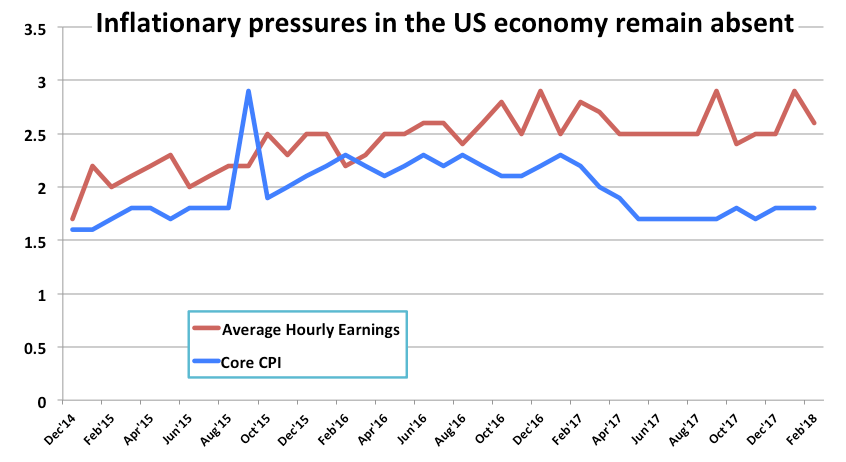

However, Tuesday’s in-line US inflation figures added to the risk rally and supported the view that the reflation trade could be losing some momentum for the time being, benefiting stocks and other riskier assets in detriment of t he buck.

In addition, heightened concerns have re-emerged around the trade policy from the Trump administration, particularly after (now ex) Secretary of State Rex Tillerson (of moderate views on trade issues) was fired on Tuesday. President Trump said CIA Director Mike Pompeo is ready to take Tillerson’s place.

Looking ahead, Retail Sales for the month of February will be the salient event in the US docket, seconded by DoE’s weekly report on US crude oil inventories.

US Dollar relevant levels

As of writing the index is gaining 0.08% at 89.75 and a break above 90.57 (high Feb.8) would open the door to 90.93 (high Mar.1) and finally 91.00 (high Jan.18). On the other hand, the next support aligns at 89.43 (low Mar.7) seconded by 88.44 (low Jan.26) and then 88.25 (2018 low Feb.16).