WTI rebounding at 61.40 amid US sanctions against Russia

- Saudi's Bin Salman in the US to visit Trump this Monday.

- Trump sanctions against Russia increases geopolitical tensions.

Crude oil is trading at around $62.16, virtually unchanged on the day as Mohammed bin Salman, Deputy Crown Prince and Minister of Defense of the Kingdom of Saudi Arabia is set to get to the United States on Monday for a multi-city trip, which will focus on reinforcing the US-Saudi ties and discussing political and investment agreements between the two powers. This meeting, along with the dismissal of Rex Tillerson might be increasing the odds of the canceling of the nuclear deal. Europe seems eager to keep the deal in place and might try to convince Trump to get the US to stay in the deal. According to sources, the US might re-negotiate the current deal.

On the Russian front, possibilities of Russian sanctions exist. According to some analysts, Putin won a rigged election and is coming under scrutiny by the UK and the US for the use of nerve agent to poison an ex-spy. Putin said it was nonsense, however, the facts lead back to Putin as the nerve agent happened to be an old Soviet recipe.

According to Reuters, Eni, the Italian oil major, will discuss sanctions against Russia with authorities in the EU and the US to gain clarity on the economic rivalry between Trump and Moscow. According to OIL Price, Eni signed a cooperation agreement with Rosneft in 2017 to explore fossil fuel deposits in the Barents Sea and the Black Sea. Trump has boosted sanctions against Russia to retaliate against Moscow’s interference in the 2016 presidential elections and other cyber attacks.

Trump issued several sanctions against Russia for organizing a cyberattack on the US energy grid, aviation systems, and other infrastructure, according to a report by the Associated Press. Deputy Foreign Minister Sergei Rybakova said Moscow is preparing a response to the sanctions against Russia.

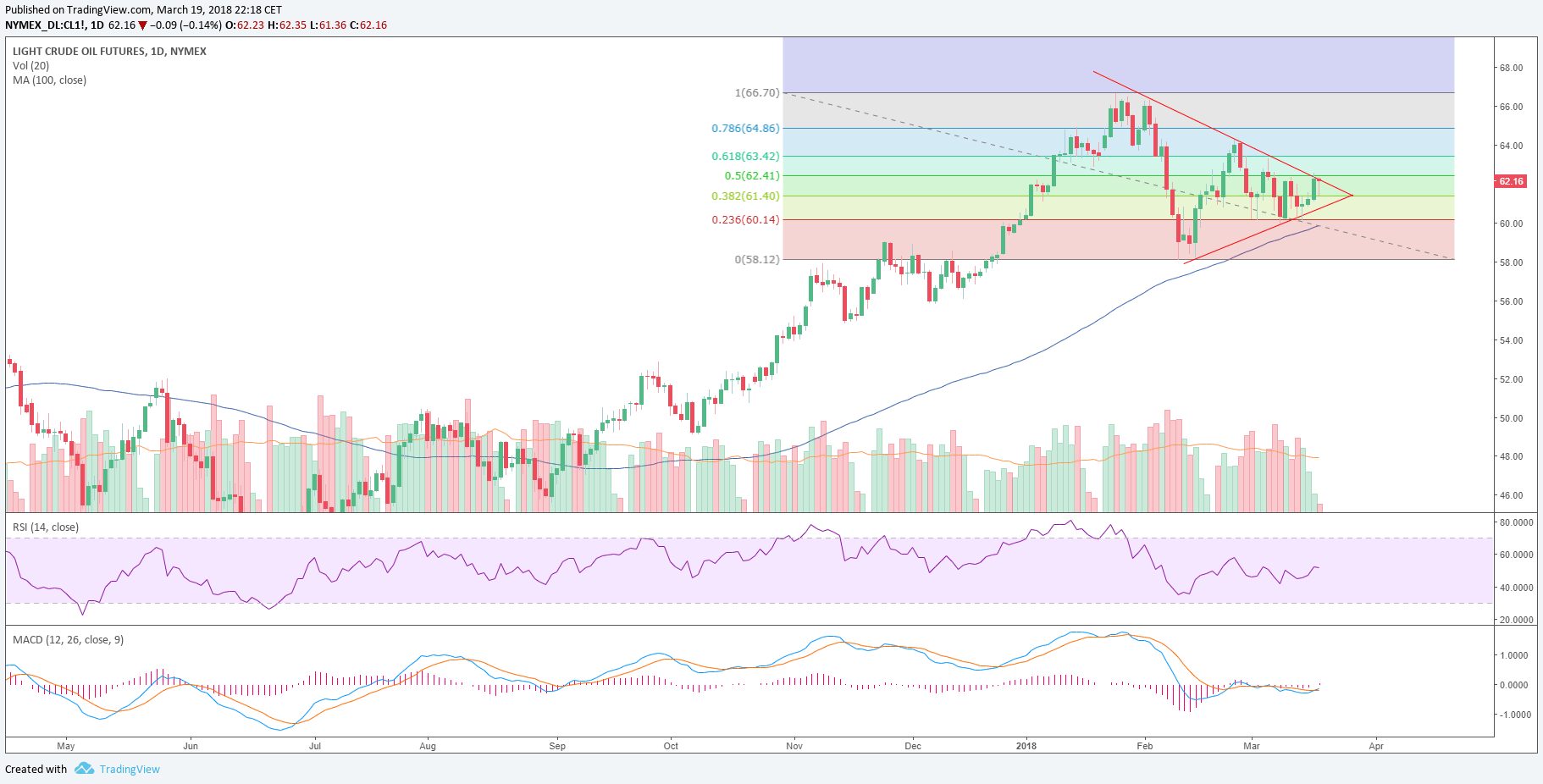

WTI daily chart

On Wednesday WTI fell to 61.40 to see a sharp reversal up and finishing the day on the high note at around 62.16. A break below 60 will likely lead to a test of 58 cyclical low while a break above the descending trendline might bring the price to revisit 64, last swing high and 66.60 the high for the year.