Back

11 Sep 2018

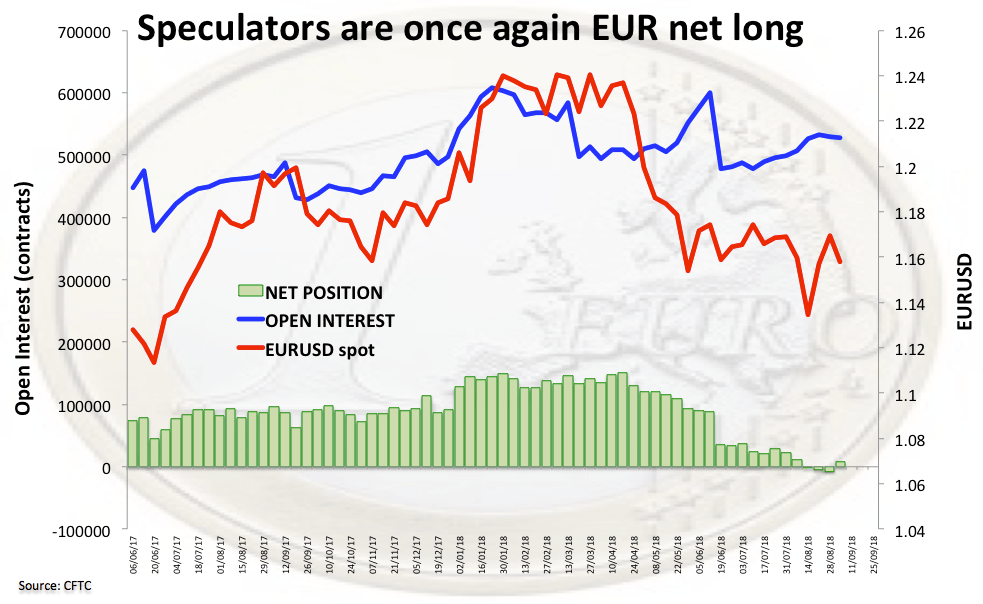

CFTC report: EUR net positions back to the positive territory

These are the main highlights of the latest CFTC report for the week ended on September 4:

- Speculators are EUR net longs for the first time since August 7. Despite this correction, the fragile situation in the EM FX space, the steady-for-longer stance from the ECB vs. the Fed and concerns surrounding Italy should keep weighing on the European currency in the next months

- USD net longs shrunk to 3-week lows ahead of the critical report on the US labour market, as the sentiment improved in the EM universe and the rhetoric around US-China trade spat mitigated somewhat. Occasional dips in the buck, however, are expected to remain limited.

- Investors trimmed their GBP net shorts to 3-week lows amidst renewed hopes on a EU-UK agreement regarding a ‘soft’ Brexit.

- RUB net longs fell to the lowest level since early September 2017 on the back of increasing concerns surrounding the EM FX space and potential further sanctions.