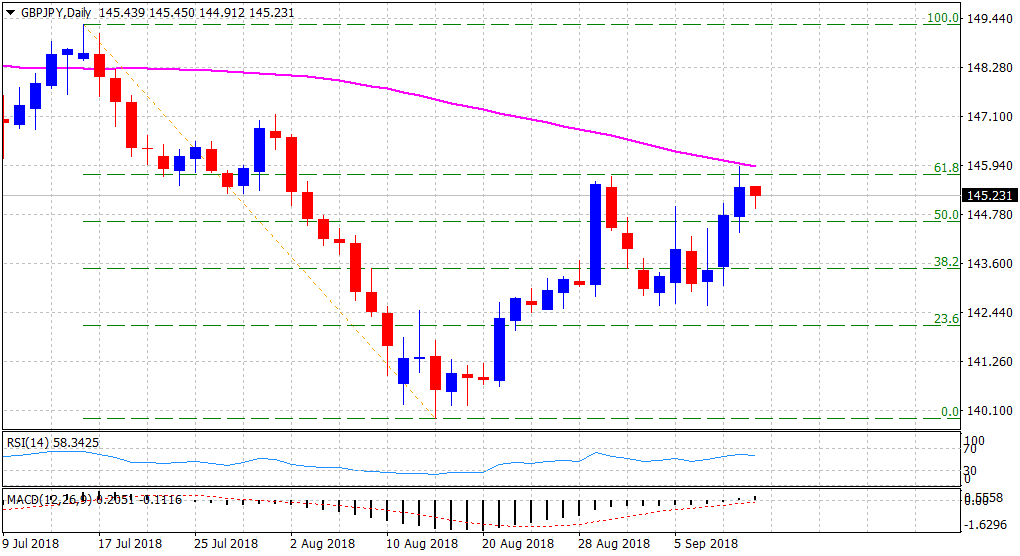

GBP/JPY Technical Analysis: Retreats farther from over 1-month tops, 100-DMA hurdle

• The cross extended overnight retracement slide from 100-day SMA barrier and traded with a mild negative bias through the early European session on Wednesday.

• The mentioned barrier nears the 61.8% Fibonacci retracement level of the 149.31-139.90 downfall and thus, should act as a key trigger for any further up-move.

• Meanwhile, technical indicators on the daily chart have managed to hold in positive territory and should continue to limit any immediate sharp decline, at least for now.

• Moreover, some softening in Japanese Yen, following a positive start across European equity markets, further assisted to reverse a dip/pare early losses to sub-145.00 level.

• However, in absence of any fresh positive Brexit headline, attempted upside moves are more likely to remained capped below the mentioned barrier amid looming trade rhetoric.

GBP/JPY daily chart

Spot Rate: 145.23

Daily Low: 144.91

Daily High: 145.45

Trend: Neutral

Resistance

R1: 145.45 (current day swing high)

R2: 145.92 (100-day SMA)

R3: 146.17 (R1 daily pivot-point)

Support

S1: 144.90 (50-period SMA H1)

S2: 144.59 (S1 daily pivot-point)

S3: 144.35 (overnight swing low)