Back

23 Oct 2018

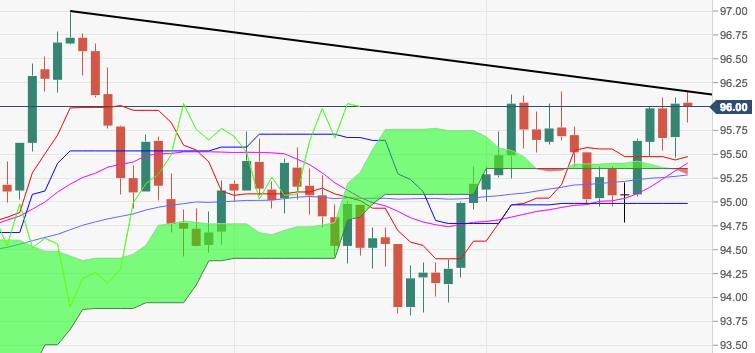

DXY Technical Analysis: The greenback faces formidable resistance just above 96.00

- DXY has once again failed to extend the breakout of the critical 96.00 milestone on sustainable basis today, although it remains lingering over that key level so far.

- The greenback needs to advance beyond the low-96.00s, where coincide recent peaks, a Fibo retracement of the 2017-2018 drop at 96.04 and the short term resistance line, today at 96.16.

- If the up move gathers serious traction, the YTD peak in levels just shy of 97.00 the figure should emerge on the horizon.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 95.98

Daily change: -5.0 pips

Daily change: -0.0521%

Daily Open: 96.03

Trends:

Daily SMA20: 95.38

Daily SMA50: 95.22

Daily SMA100: 94.95

Daily SMA200: 92.88

Levels:

Daily High: 96.09

Daily Low: 95.47

Weekly High: 96.09

Weekly Low: 94.79

Monthly High: 95.74

Monthly Low: 93.81

Daily Fibonacci 38.2%: 95.85

Daily Fibonacci 61.8%: 95.71

Daily Pivot Point S1: 95.64

Daily Pivot Point S2: 95.24

Daily Pivot Point S3: 95.02

Daily Pivot Point R1: 96.26

Daily Pivot Point R2: 96.48

Daily Pivot Point R3: 96.88