Back

16 Nov 2018

S&P500 Technical Analysis: Inverse Head-and-Shoulders pattern can send US Stocks to the 2,820.00 level

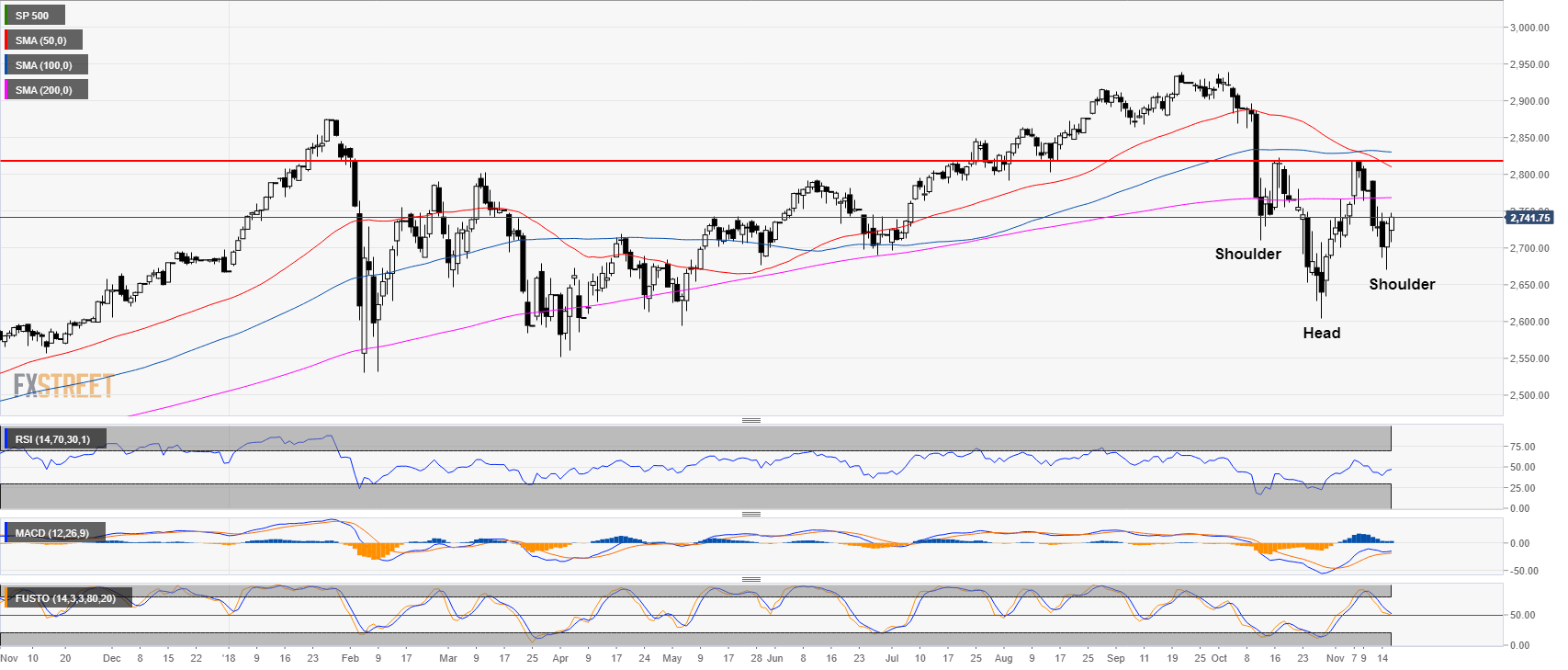

S&P500 daily chart

- The S&P500 printed an inverse head-and-shoulders pattern, which can potentially send the index up in the coming days and weeks.

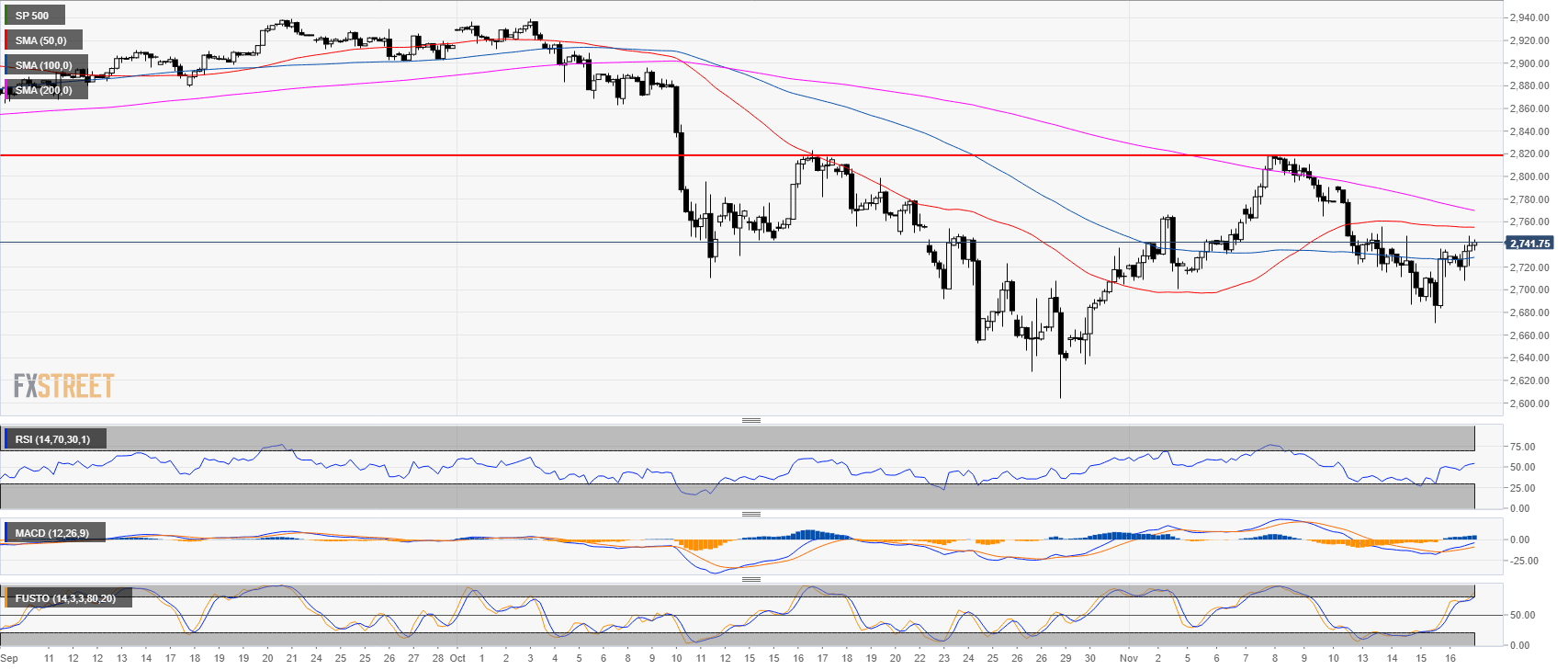

S&P500 4-hour chart

- The S&P500 found strong support at the 2,680.00 level as the bulls reclaimed the 100-period simple moving average (SMA).

- Technical indicators are in positive territories suggesting continued bullish momentum.

- The bull target is at 2,820.00 swing high. A bear breakout below 2,680.00 would invalidate the bullish momentum.

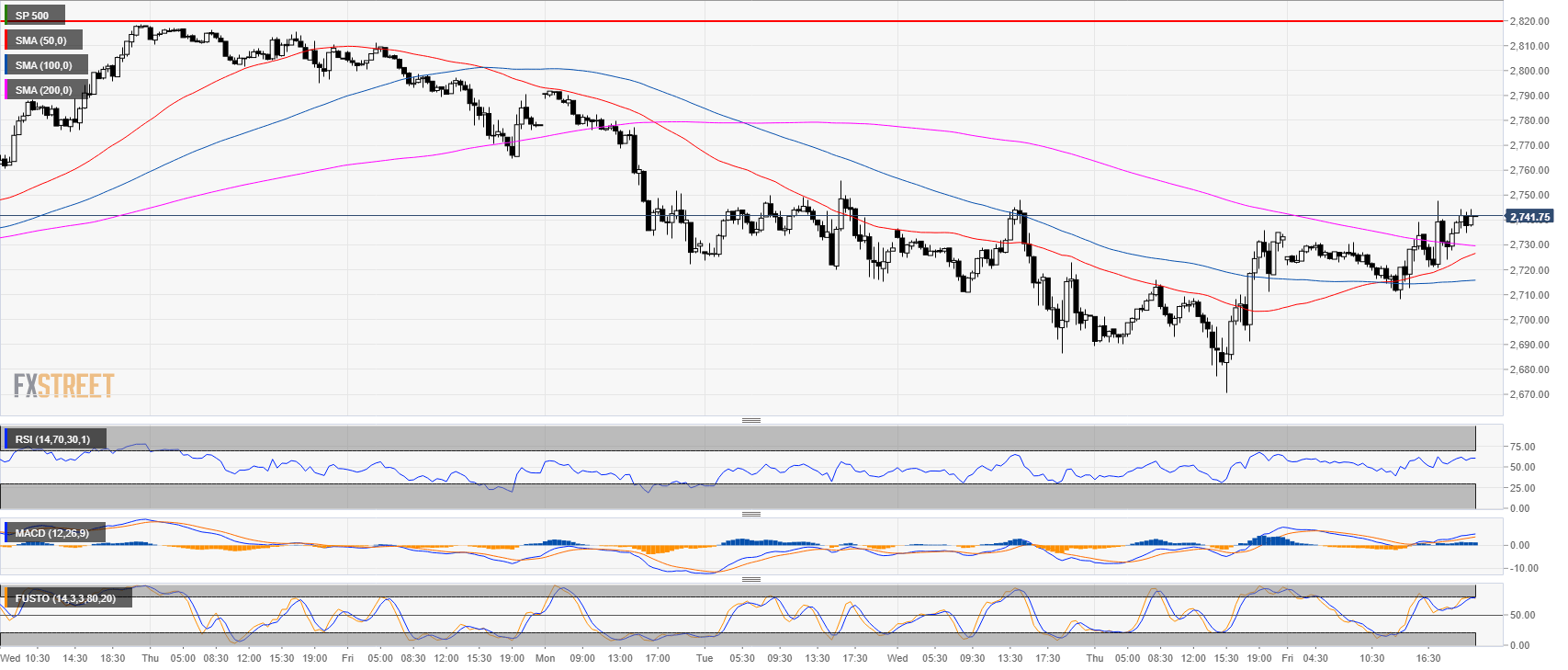

S&P500 30-minute chart

- The market is almost in full bull mode on the 30-minute chart.

- The S&P500 broke above the 50, 100 and 200 SMA while technical indicators are in positive territories.

Additional key levels at a glance:

SP 500

Overview:

Last Price: 2741.75

Daily change: 8.5e+2 pips

Daily change: 0.311%

Daily Open: 2733.25

Trends:

Daily SMA20: 2729.16

Daily SMA50: 2813.38

Daily SMA100: 2830.72

Daily SMA200: 2768.26

Levels:

Daily High: 2736

Daily Low: 2670.75

Weekly High: 2818.75

Weekly Low: 2713.5

Monthly High: 2939.5

Monthly Low: 2604.5

Daily Fibonacci 38.2%: 2711.07

Daily Fibonacci 61.8%: 2695.68

Daily Pivot Point S1: 2690.67

Daily Pivot Point S2: 2648.08

Daily Pivot Point S3: 2625.42

Daily Pivot Point R1: 2755.92

Daily Pivot Point R2: 2778.58

Daily Pivot Point R3: 2821.17