Back

4 Feb 2019

US Dollar Index Technical Analysis: Consolidative Tuesday for the Greenback

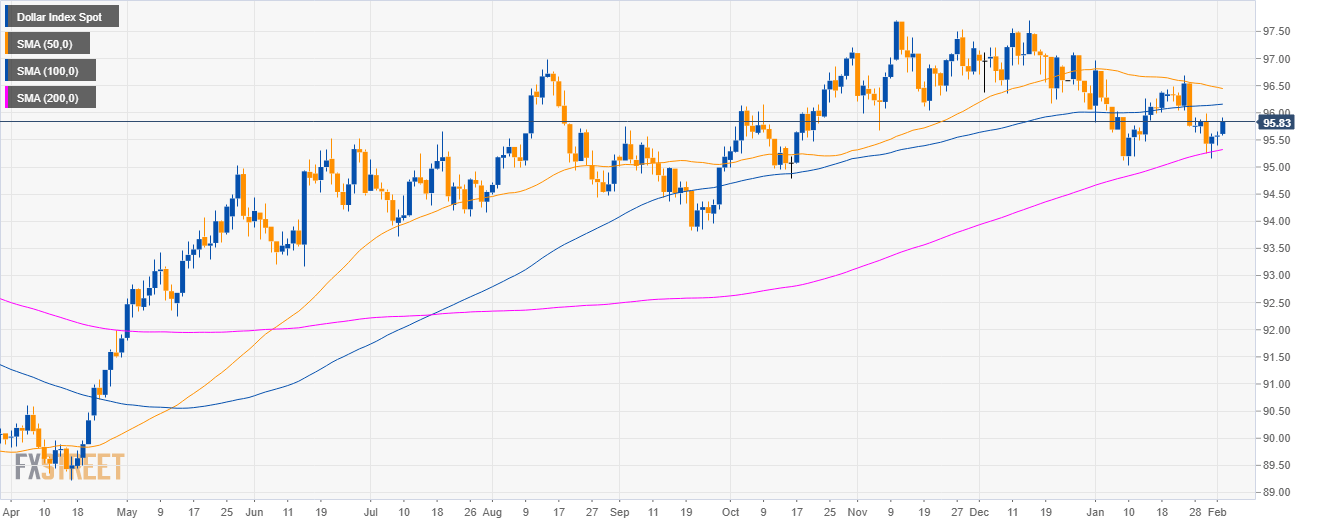

DXY daily chart

- The US Dollar Index (DXY) is in a bull trend above 200-day simple moving average (SMA).

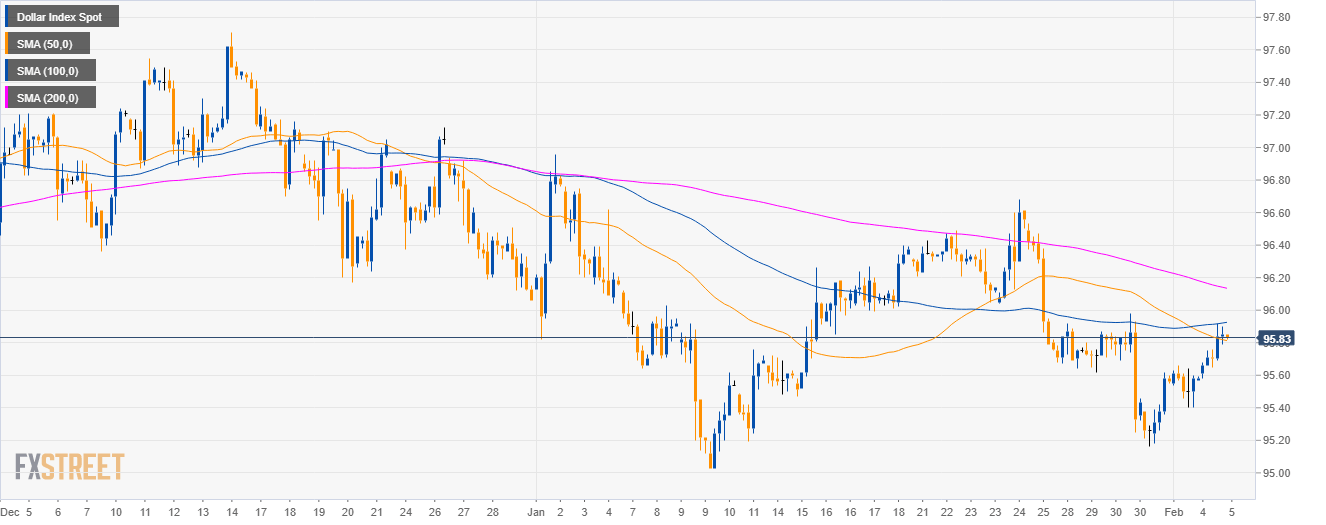

DXY 4-hour chart

- DXY is trading below its 100 and 200 SMA suggesting bearish momentum in the medium-term.

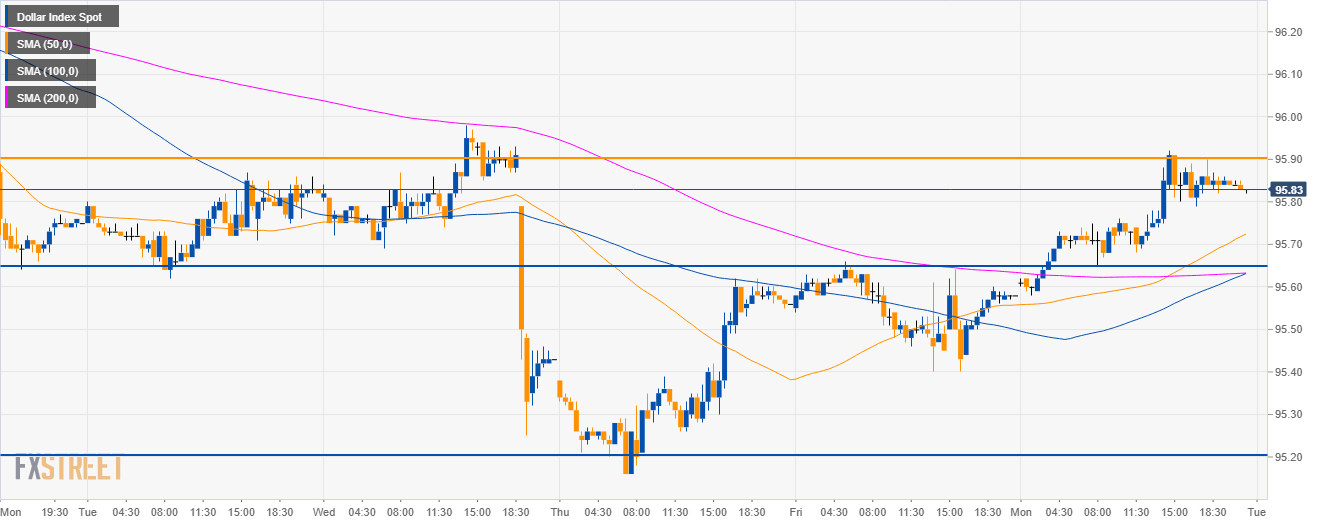

DXY 30-minute chart

- DXY is trading just below the 95.90 resistance.

- Bears will most likely want to resume the move initiated last week by trying to reach the 95.65 level.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 95.83

Today Daily change %: 0.26%

Today Daily Open: 95.58

Trends:

Daily SMA20: 95.87

Daily SMA50: 96.47

Daily SMA100: 96.15

Daily SMA200: 95.3

Levels:

Previous Daily High: 95.66

Previous Daily Low: 95.4

Previous Weekly High: 95.98

Previous Weekly Low: 95.16

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 95.56

Daily Fibonacci 61.8%: 95.5

Daily Pivot Point S1: 95.43

Daily Pivot Point S2: 95.29

Daily Pivot Point S3: 95.17

Daily Pivot Point R1: 95.69

Daily Pivot Point R2: 95.81

Daily Pivot Point R3: 95.95