Oil Crude Oil Price and Forecast: WTI bounces amid OPEC speculation, upbeat data

WTI corrects OPEC-story supply on upbeat Chinese weekend data

Meanwhile, a growing theme has been with the Saudis subsidizing other members for other members’ excessive production and reports were circulating that the nation would not be willing to continue doing so. In a Bloomberg report, the article stated that "OPEC and allied crude producers are averse to deepening output cuts when they convene". Additionally, there were fears that Russia would block an OPEC+ quota extension.

The price of oil had otherwise been elevated in a correction from the early October lows down below the $51 handle on the sentiment of production cuts with WTI moving up from the depths of the 2018 lows in the $42 handle to a YTD high on the $66 handle. Read more…

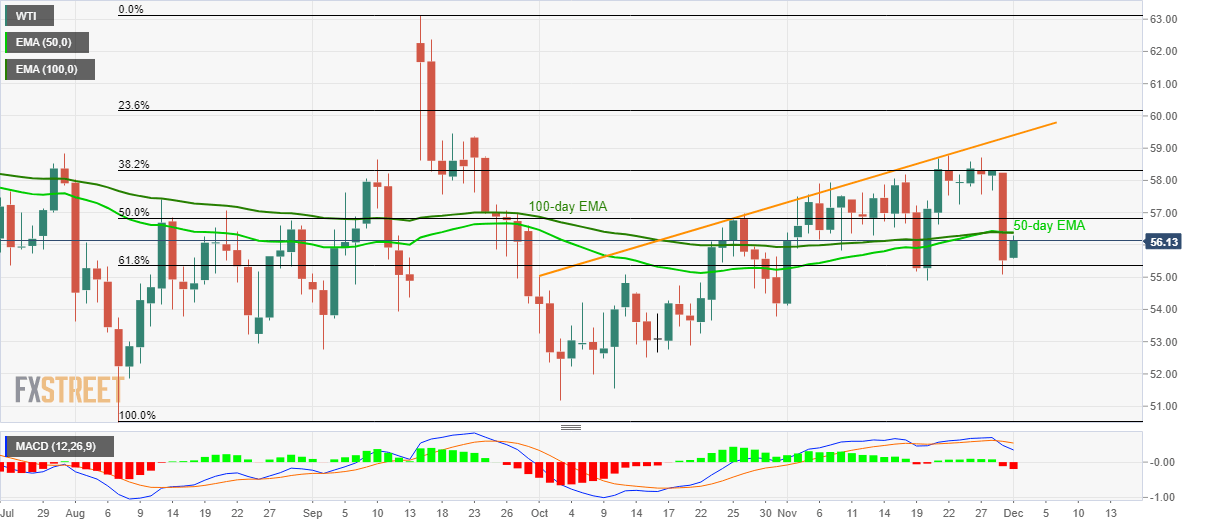

WTI Technical Analysis: 50/100-day EMA question pullback from 61.8% Fibonacci

WTI’s recent pullback from 61.8% Fibonacci retracement helps it mark 1.1% gains while taking the bids to $56.15 by the press time of early Monday.

The energy benchmark presently confronts a join of 50 and 100-day EMA, which together with bearish signals from 12-bar Moving Average Convergence and Divergence (MACD) can trigger the quote’s another attempt to declines below the key Fibonacci retracement level of $55.35. Read more....

WTI daily chart