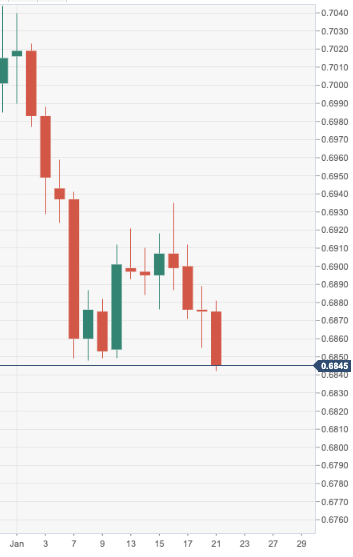

AUD/USD marks a lower lower below neckline support, buyers looking for entry point

- AUD/USD bears pile in below H&S neckline as risk aversion takes hold.

- Data leading up to the RBA meeting will be critical.

AUD/USD bears are chipping away on the downside as markets get set for the Aussie jobs data later in the week. The fundamentals for the Aussie are heavily weighted to the downside with the Reserve bank of Australia meeting on the horizon, 4th Feb, following a series of downbeat data releases (besides strong retail sales report for November) and the bushfires.

The RBA’s three rate cuts in 2019 were a heavy weight for the Aussie which extended the 2018 decline, testing the 200-day moving average on three occasions, failing miserably to penetrate it and subsequently falling from a 2019 high of 0.7295 to a 2019 low of 0.6670. Despite the notion of QE2020, the currency has managed to recover in a bullish channel from there to a December 2019 high of 0.7031, forming a H&S and a lower-low today below the neckline to 0.6842 with plenty at stake in the lead up to the highly anticipated RBA.

RBA meeting on the radar, with the RBA meeting on 4th Feb

In its Statement on Monetary Policy, the RBA clarified that “the Board is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the medium-term inflation target over time”.

The minutes of the December monetary policy meeting made it clear that the Board will be reassessing the economic outlook next February, noting that “economic growth and the unemployment rate remain broadly consistent with the forecasts. However, members agreed that it will be concerning if there were a deterioration in the outlook.

While the US and Chinse trade deal goes some way to buoy economic growth prospects in the near term, the bushfires and prospects of a disappointment in this week's jobs data (the unemployment rate is a very important source of attention for the Board) could serve for a downside bias for the Aussie, a currency already submerged below series if heavily bearish days of trade for the month so far:

AUD/USD daily price action YTD

- Australia: Critical employment report ahead – ANZ

Westpac expects that the unemployment rate will drift higher to around 5.6% in the June quarter from the current 5.3%, but any deterioration here sooner will b a massive blow for the Aussie.

There will be a keen eye on wages this week as well, as the concerns about weak wages growth remain central to the Board: “it was noted that the current rate of wages growth was not consistent with inflation being sustainably within the target range… nor was it consistent with consumption growth returning to trend”.

Then, markets will be waiting for the Consumer Price Index later in the month as the ultimate round of key domestic data ahead for the RBA to mull. “The Q4 2019 CPI report due at the end of January will, as always, provide key information for the RBA ahead of its February meeting; but only a major surprise would upset the RBA’s outlook. We expect headline inflation for the quarter to jump to 0.7% q/q and 1.9% y/y. Trimmed mean inflation is expected to be more restrained at 0.4%and 1.6% in quarterly and annual terms, respectively,” analysts at ANZ bank explained.

QE on the horizon? We will have to wait and see

Last year, RBA Governor Lowe outlined some parameters with respect to the use of unconventional policies in Australia. Although he made clear that conditions were currently not ripe for QE, he indicated that if the Cash rate was cut by an additional 50 bps to 0.25%, then the RBA could embark on an asset purchases programme.

It is possible that this could if economic headwinds were to persist and considering that here are some expectations that tensions between the US and China will rise again in the months ahead, this would accelerate the economic headwinds blowing across Australia. With the view that both the Cash rate and the AUD will trend lower into 2020, AUD/USD could be forecasted to head towards the 0.6600 handle on a 3-month view.

Markets catching the flu, weighing on AUS and risk sentiment

Meanwhile, we have been in risk-off mode in recent trade. Global markets have reacted negatively to news of virus spreading in China while US markets also took into account the gloomy IMF report after being closed the previous day – more on that here.

AUD/USD levels

-

AUD/USD Forecast: Heading toward 0.6770 as risk aversion rules

(AUD/USD Price Analysis: More to come ...)