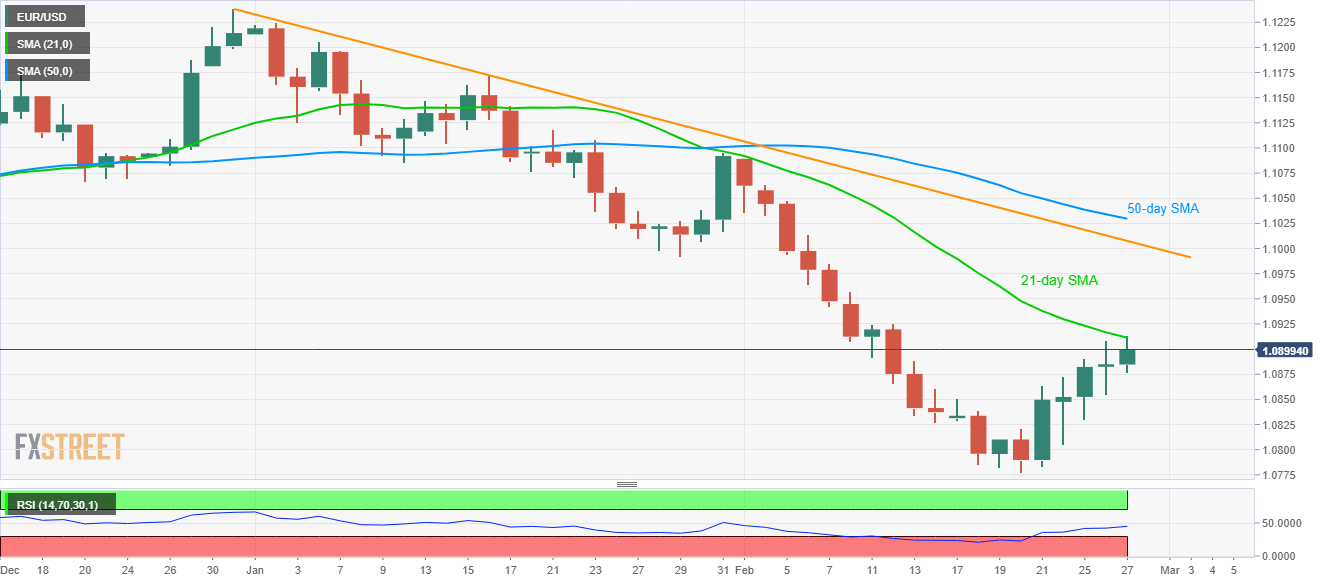

EUR/USD Price Analysis: 21-day SMA probe buyers near two-week high

- EUR/USD registers a five-day winning streak.

- Recovering RSI can escalate the pullback towards short-term trend line resistance, 50-day SMA.

- Sellers will take entry below 1.0830 while targeting the fresh low since April 2017.

EUR/USD marks 0.15% gains to 1.0900 during the early-day Asian trading on Thursday. While the recovery in the RSI conditions from the oversold area seems to favor the buyers to flash two-week top, 21-day SMA acts as the immediate upside barrier.

That said, the pair’s sustained break of 21-day SMA level of 1.0911 can aim for January 29 low near 1.0992 ahead of confronting a downward sloping trend line from December 31, currently at 1.1010.

It should also be noted that 50-day SMA, around 1.1030, will question the bulls past-1.1010.

Meanwhile, 1.0830 acts as the immediate support to watch during the pair’s U-turn, a break of which could challenge the yearly bottom close to 1.0780.

In a case where the bears refrain to respect 1.0780, 1.0680 and April 2017 low close to 1.0570 could return to the charts.

EUR/USD daily chart

Trend: Further recovery expected