Back

23 Mar 2020

GBP/USD Price Analysis: Fed and BoE go heavy on QE, Pound under pressure near 35-year’s lows

- GBP/USD is trading off the 1985 lows near the 1.1500 level.

- The Fed announces unlimited Quantitative Easing (QE).

- Last week, the Bank of England (BOE) cut interest rates and added 200 billion in QE

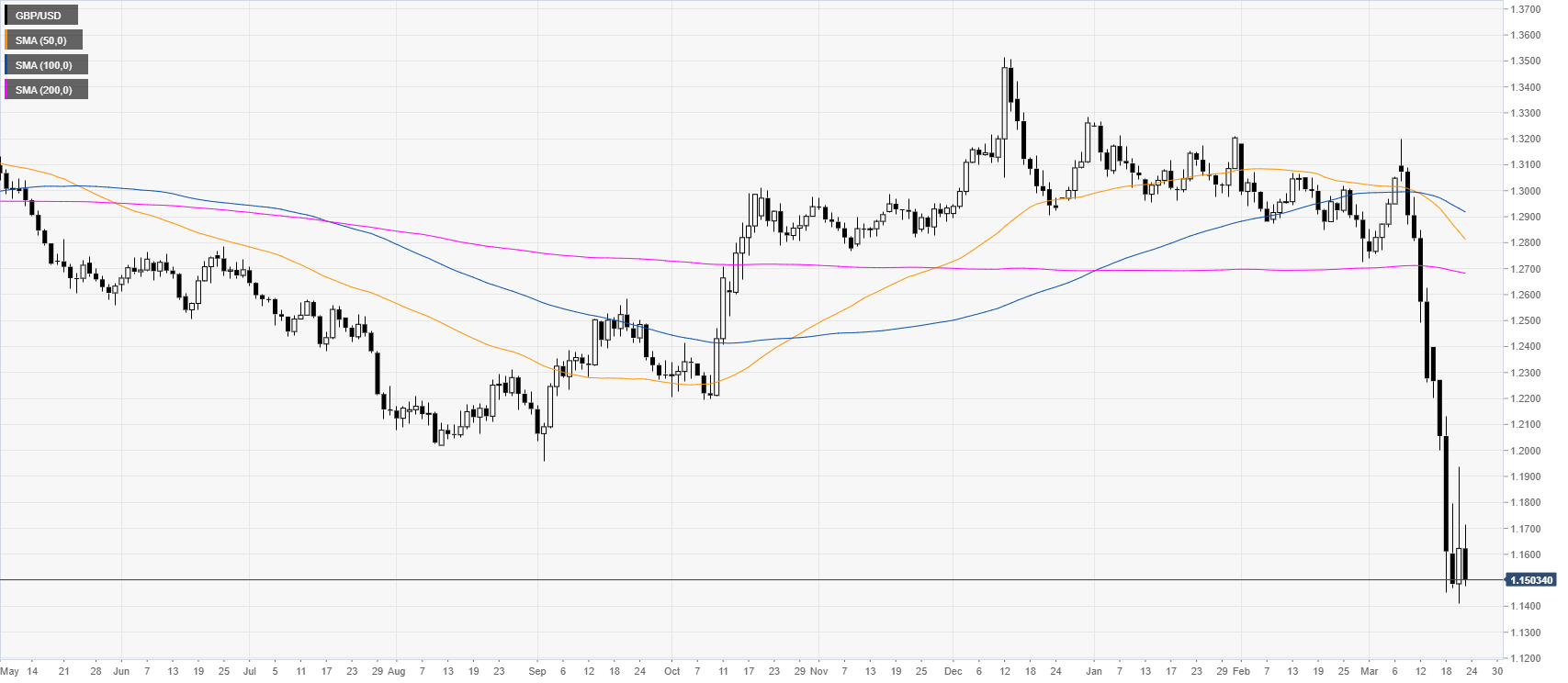

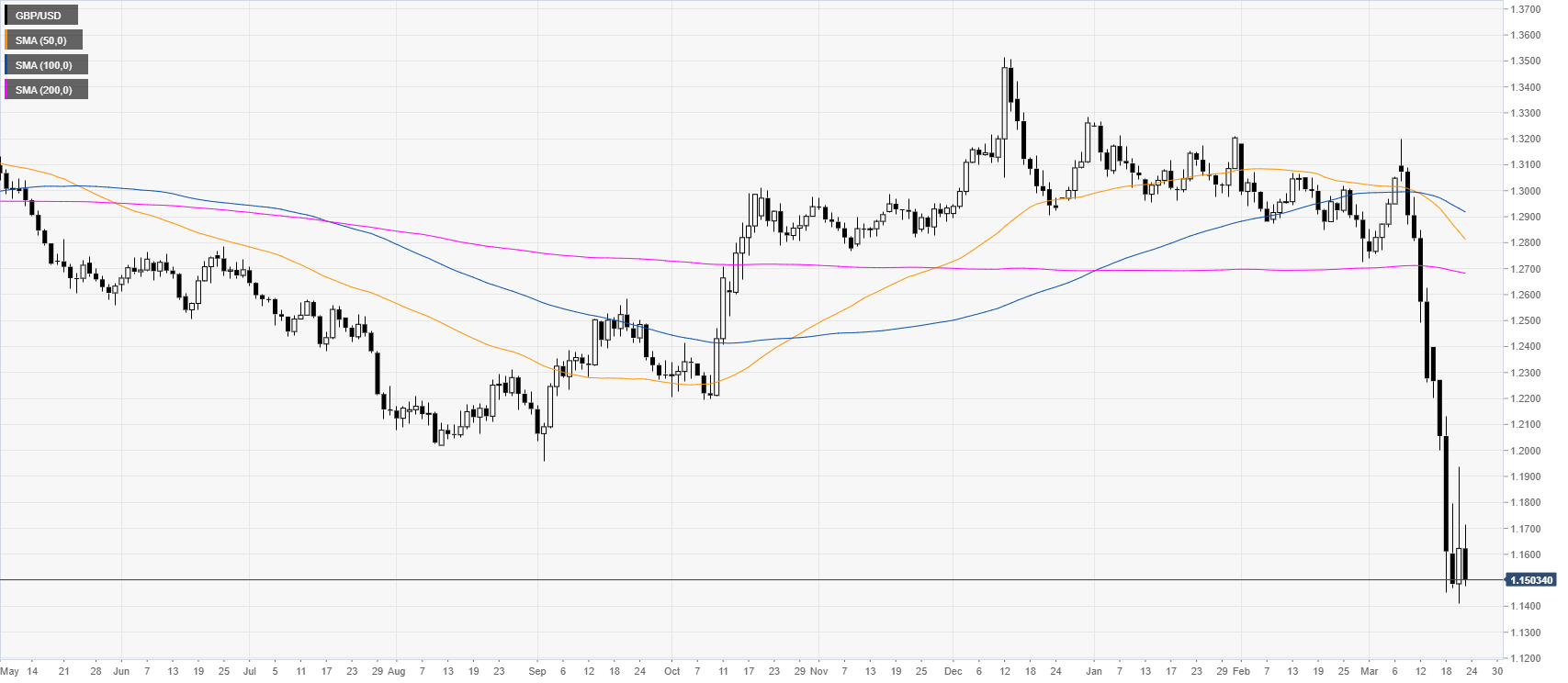

GBP/USD daily chart

GBP/USD remains under heavy selling pressure near 1985 lows as the fed launches unlimited QE. On the other side of the Atlantic, last week, the BOE cut interest rates and added 200 billion in QE.

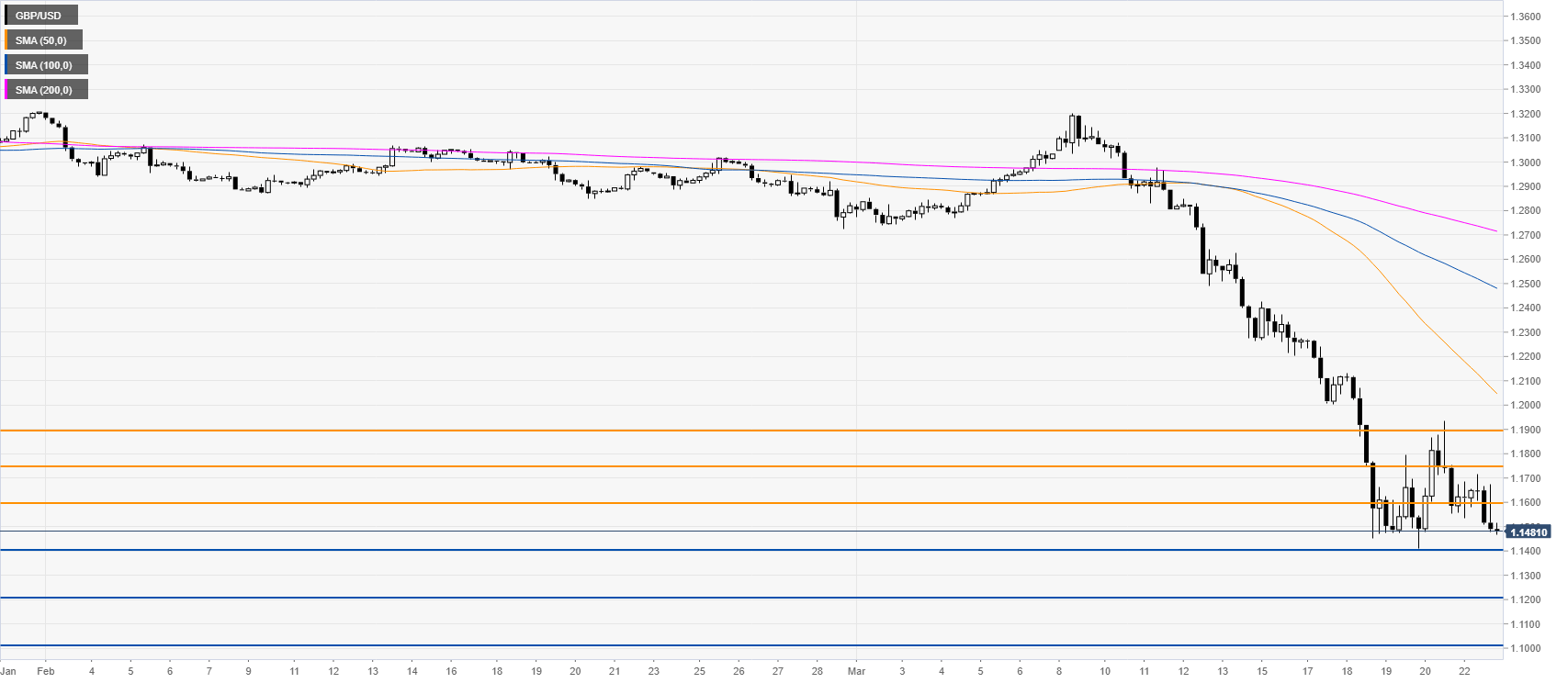

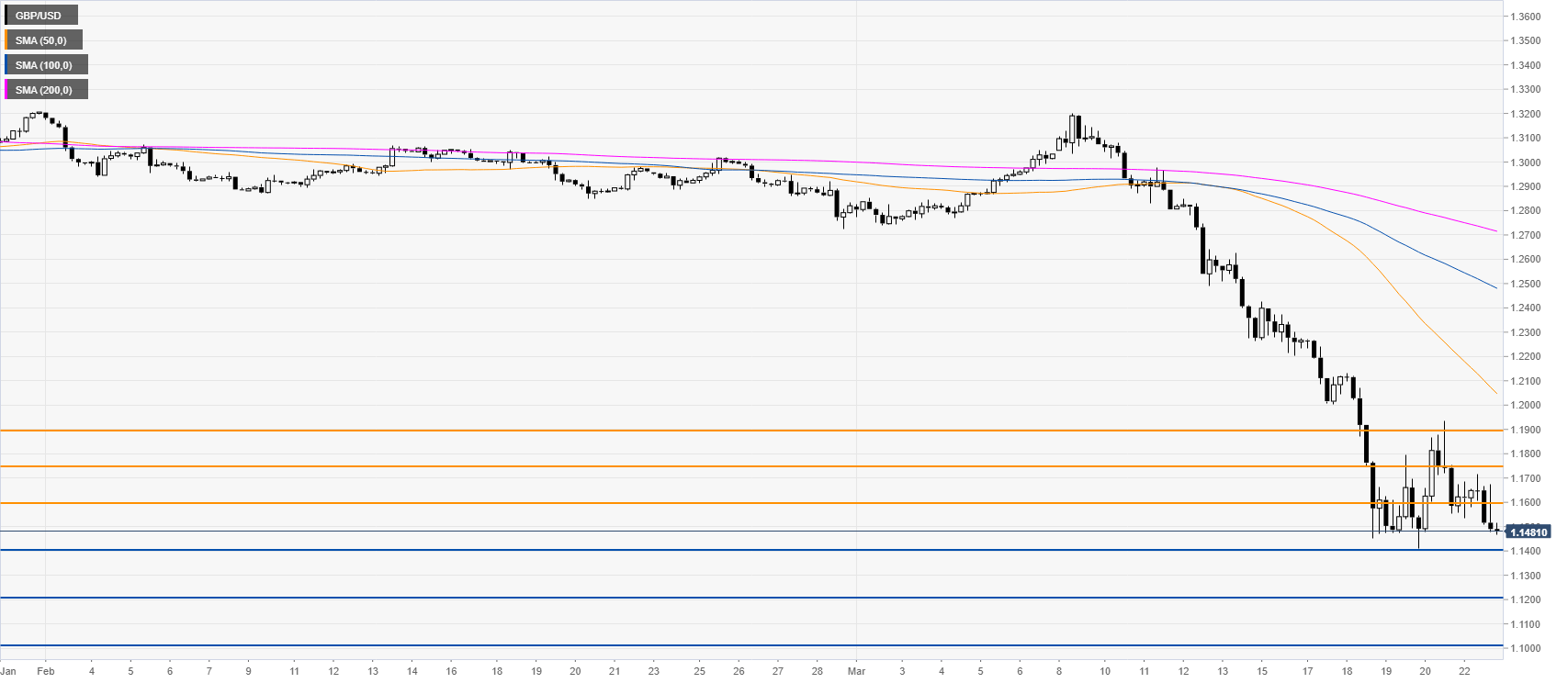

GBP/USD four-hour chart

GBP/USD is nearing the 1.1400 figure near last week’s lows as the bearish pressure remains unabated on the cable. A break below the above-mentioned level should lead to further losses towards the 1.1200 and 1.1000 levels. Resistance can be expected near the 1.1590, 1.1750 and 1.1900 levels on the way up, although bullish attempts are expected to be short-lived in this context.

Resistance: 1.1590, 1.1750, 1.1900

Support: 1.1400, 1.1200, 1.1000

Additional key levels