Back

28 May 2020

Crude Oil Futures: Extra losses not favoured

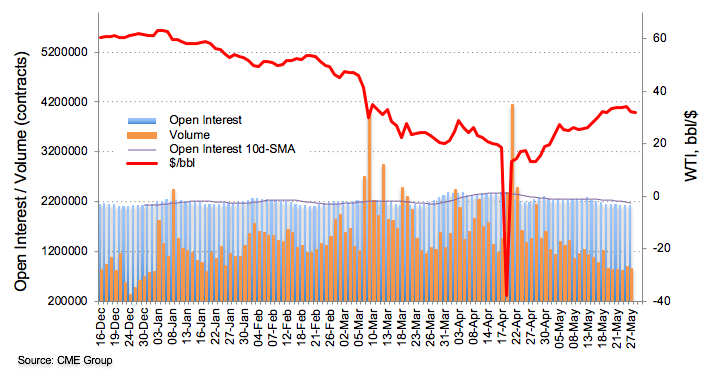

CME Group’s flash data for crude oil futures markets noted traders scaled back their open interest positions for yet another session on Wednesday, this time by almost 9.4K contracts. In the same line, volume dropped by almost 55.4K contracts against the backdrop of the persistent choppy activity.

WTI stays capped by $35.00/bbl

Wednesday’s negative price action in the barrel of WTI was amidst diminishing open interest and volume, leaving further retracements contained in the near-term. On the upside, the area around the $35.00 mark continues to act as a strong hurdle.