USD/JPY pushes lower as safe haven demand grows

- USD/JPY trades 0.62% lower on Tuesday as safe-haven demand grows in the FX markets.

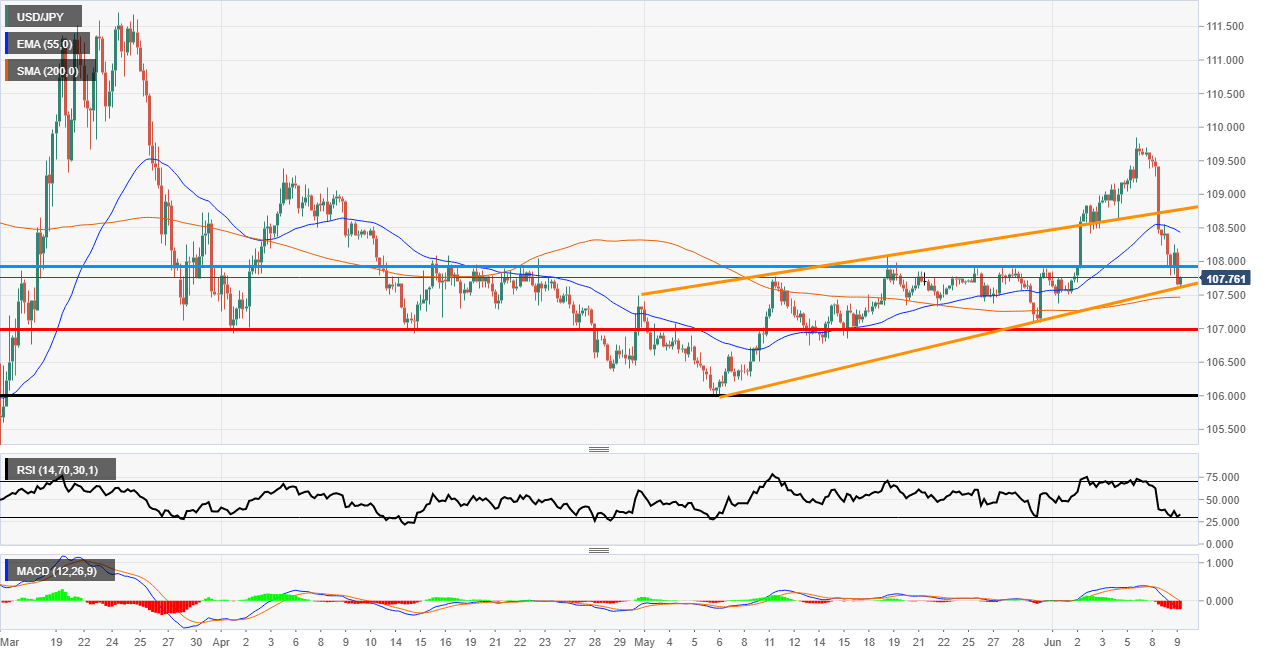

- The price has temporarily stalled at a trendline seen on the 4-hour chart.

USD/JPY 4-hour chart

Currencies like JPY and CHF have strengthened on Tuesday as the demand for safe-haven currencies grows. It has been said by some analysts that the issues between North Korea and South Korea kicked off the demand as other Asian nations piled into the Yen. The USD/JPY pair normally correlates to the stock markets but this time there is a serious divergence as the US equities indices are still on the rise.

The chart below shows the bears stepped in before the market had a chance to test the 110.00 psychological level. Since then the price has pushed back below the 55 Exponential Moving Average (EMA) and the pair has just broken below the 108.00 handle.

There has been some support at a trendline (marked in orange on the chart below) but this could be short-lived. Below that, there is the 200 Simple Moving Average (SMA) and the red support level very close but just above 107.00. The daily 55 EMA and 200 SMA's are both broken to the downside which further compounds the pairs woes.

The indicators are looking pretty bearish as the Relative Strength Index is in the oversold area and the MACD histogram is red. The MACD signal lines have also dipped below the zero line which is also indicating more bearishness is on the way.

Additional levels