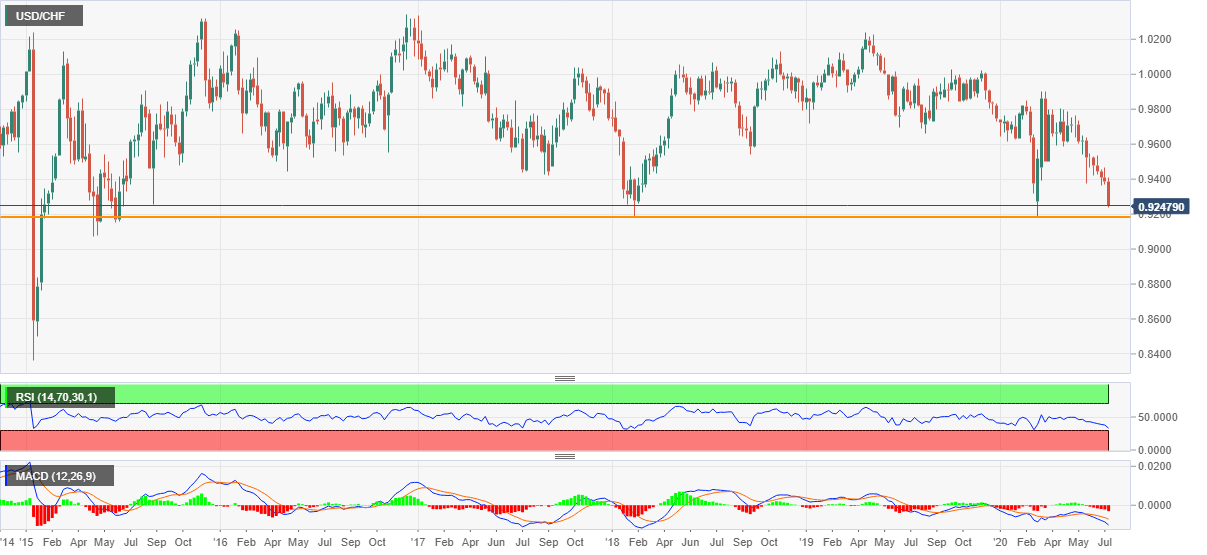

USD/CHF Price Analysis: Bears eye sub-0.9200 area as MACD turns most bearish in 29-months

- USD/CHF struggles to keep the bounce off 0.9237, the lowest since early-March.

- Bearish MACD keeps weighing on the quote, oversold RSI may restrict further downside near the key support line.

- Bulls will have a bumpy road unless crossing the monthly high past-0.9500.

USD/CHF seesaws around 0.9247 during the pre-European session on Friday. The quote trims the early-day losses while taking a U-turn from over four-month low. However, MACD signals the most bearish conditions since the initial February 2018, which in turn suggests the quote’s additional weakness.

As a result, lows marked in March 2020 and February 2018, surrounding 0.9190/80, be the key for the sellers to watch. Though, the quote’s further weakness becomes less likely considering the oversold RSI conditions.

If the traders ignore RSI signals and dominate past-0.9180, May 2015 bottom of 0.9072 could offer an intermediate halt before highlighting 0.9000 psychological magnet.

On the flip side, 0.9300 and 0.9370 may offer immediate resistance to the pair ahead of the monthly top close to 0.9530/35.

Given the bull's ability to conquer 0.9535 on a weekly closing basis, September 2018 bottom near 0.9542 will validate further upside to May 2020 low around 0.9590.

USD/CHF weekly chart

Trend: Bearish