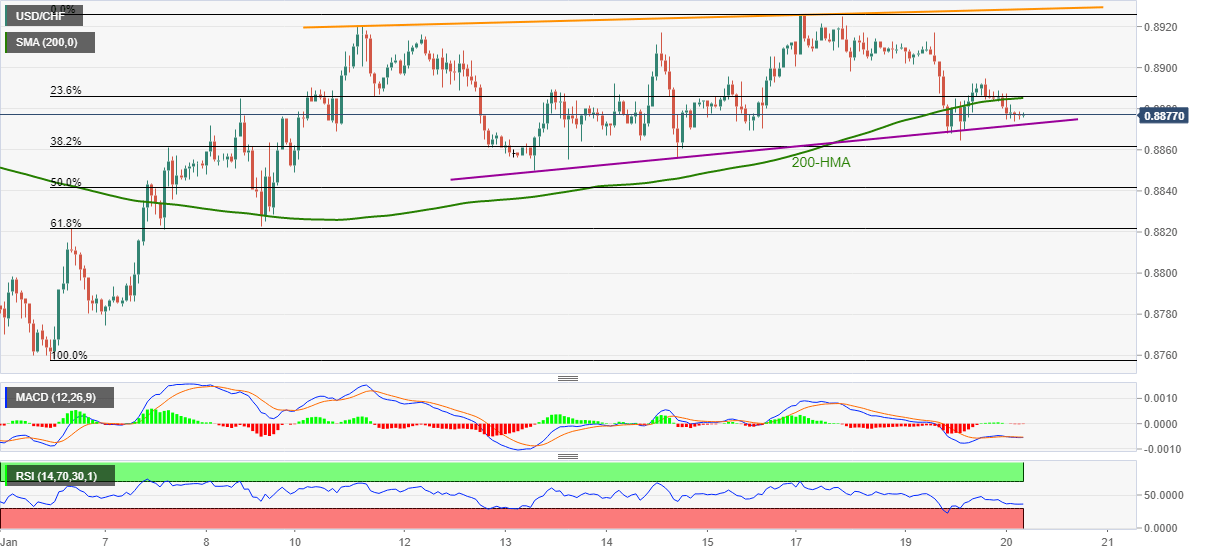

USD/CHF Price Analysis: Drops back below 200-HMA, weekly support line in focus

- USD/CHF stays mildly offered after a failed attempt to cross the key moving average.

- Sluggish MACD, RSI suggests downbeat momentum, bulls to have a bumpy road if at all return.

USD/CHF remains depressed around 0.8870, down 0.09% intraday, during early Wednesday. In doing so, the Swiss currency pair portrays a failed attempt to stay past-200-HMA despite staying above an ascending trend line from last Wednesday.

With the oscillators like RSI and MACD being sluggish, the failures to cross key moving average can drag the quote back to the stated support line, at 0.8870 now.

However, any further weakness will not hesitate to challenge 61.8% Fibonacci retracement of January 06-18 upside, near 0.8820.

During the quote’s weakness below 0.8820, the 0.8800 threshold and the monthly low near will lure the USD/CHF bears.

On the contrary, USD/CHF buyers’ return will be initially probed by the confluence of 200-HMA and 23.6% Fibonacci retracement level around 0.8886.

Though, any further upside beyond 0.8886 will have to cross an ascending trend line from January 11, near 0.8930 to the eye for the 0.9000 round-figure.

USD/CHF hourly chart

Trend: Pullback expected