Gold Price Analysis: XAU/USD faces wall of resistance as silver remains in focus – Confluence Detector

The frenzy in stock markets has moved from GameStop and AMC to silver prices. XAG/USD hit an eight-year high before falling down back to previous levels. In the meantime, President Joe Biden is pushing to "go big" on stimulus, but instead of boosting gold, it is causing a sell-off in bonds. In turn, higher Treasury yields make the dollar more attractive.

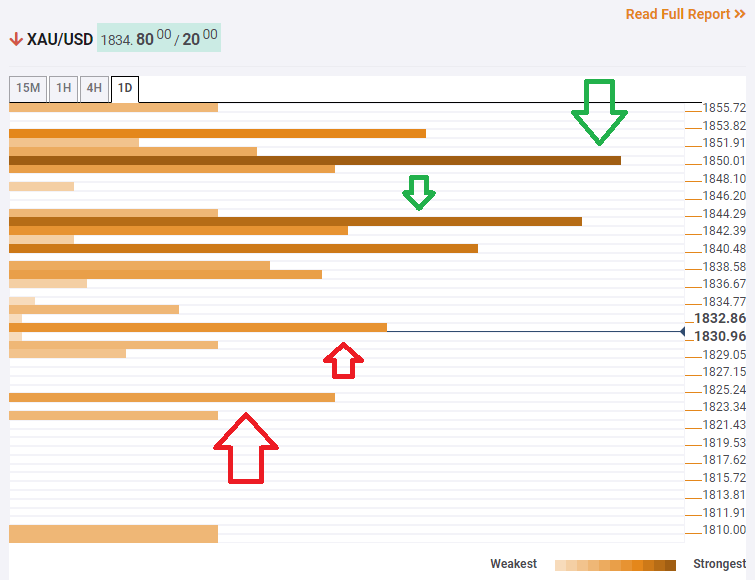

How is XAU/USD positioned on the technical graphs?

The Technical Confluences Indicator is showing that the precious metal faces some resistance around $1,843, which is a cluster including the Bollinger Band 1h-Upper, the Simple Moving Average 10-4h and the Fibonacci 38.2% one-day.

Another strong cap awaits at $1,850, which is the convergence of two meeting points – the SMA 100-1h, the SMA 100-4h, and the SMA 50-4h.

Some support awaits at $1,830, which is the meeting point of last week's low and the BB 4h-Lower.

Another soft cushion is at $1,824, which is the confluence of the Pivot Point one-week Support 1 and the PP one-day S1.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence