USD/CAD bulls eye a significant retracement of daily bearish impulse

- USD/CAD is finally stabilising after several bearish daily closes.

- Bulls can target a 38.2% Fibo ahead of a 61.8% Fibo on the daily bearish impulse.

The commodity-linked cross is currently trading at 1.2463 and higher by 0.47% at the time of writing having climbed from a low of 1.2365 to a high of 1.2481.

Glancing over the latest positioning data, CAD net long positions dropped back having jumped higher the previous week.

Whereas, net USD short positions shrunk for a third consecutive week and there has been a better tone of the greenback in the spot market of late also.

The USD has been one of the best performing G10 currencies in recent weeks reflecting a shift in expectations regarding Fed interest rate policy as well as positive projections for economic growth due to US fiscal policy.

Moreover, the vaccine roll-out is faster than Canada's which has been experiencing a slow vaccine roll-out programme.

The CAD had been experiencing at least a positive backdrop due to the better tone in oil prices, but the bears are back in play today and oil prices are under pressure.

At the same time, US bond yields are firmer having scored a fresh post-Federal Reserve high of 1.7540% in the 10-year Treasury yield.

These are the highest levels in 13 months, scored in early in London trade, climbing above 1.70% for the first time since Jan. 24, 2020 and some more at the start of New York trade.

This has led to a bid in the US dollar which is higher by 0.35% as measured in the DXY index. DXY has moved up from a low of 91.3010 to a high of 91.8960.

Oil rout continues

Meanwhile, oil prices have sunk for the fifth day in a row on Thursday to their lowest in two weeks.

The fifth day of declines for both Brent and WTI futures contracts also marks the longest losing streak for WTI since February 2020 and for Brent since September 2020.

A further increase in US crude and fuel inventories and the weight of the ever-present COVID-19 pandemic is weighing on oil prices.

The negative sentiment was kicked off by doubts in Europe over the AstraZeneca vaccine and was ossified by the nearly 2.4 million-barrel build in US crude inventories.

US government data on Wednesday showed crude inventories have risen for four straight weeks after severe cold weather in Texas and the central part of the country in February forced shutdowns at refineries.

Additionally, the International Energy Agency said on Wednesday that the Paris-based energy watchdog does not expect oil prices to enter a supercycle or an extended period where prices rise well above their long-run trend.

All of the above is pointing to a period of USD/CAD strength and the following technical analysis illustrates where prices could be headed.

USD/CAD technical analysis

-637516875706611835.png)

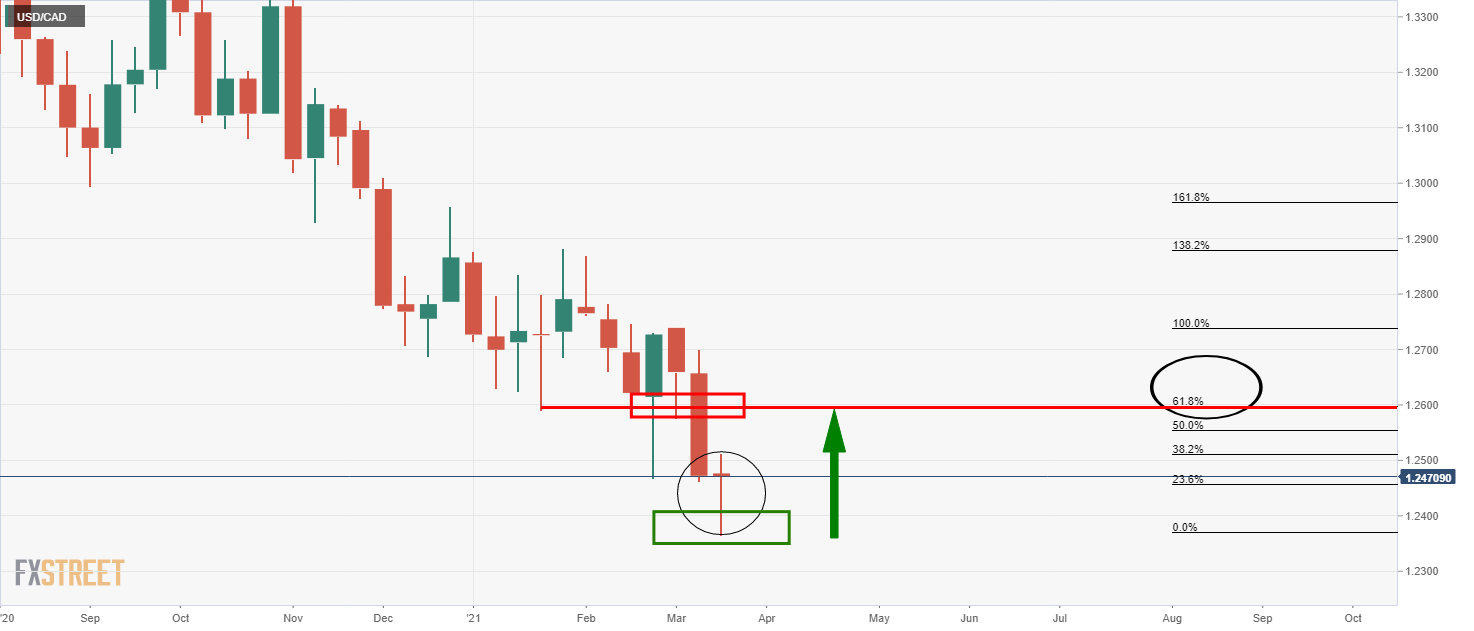

The monthly chart above shows that the price is in dipping the toe in an area of demand.

While there is every possibility of the price to continue lower, there are prospects of a sizeable upside correction beforehand.

Weekly chart

We are just over a day away from the close of the week.

The current weekly candle's wick will be bullish if the price can close higher than the prior week's close.

In doing so, there are prospects of a deeper upside correction beyond current resistance, 22. Feb lows, and towards higher resistance around a 61.8% Fibonacci retracement.

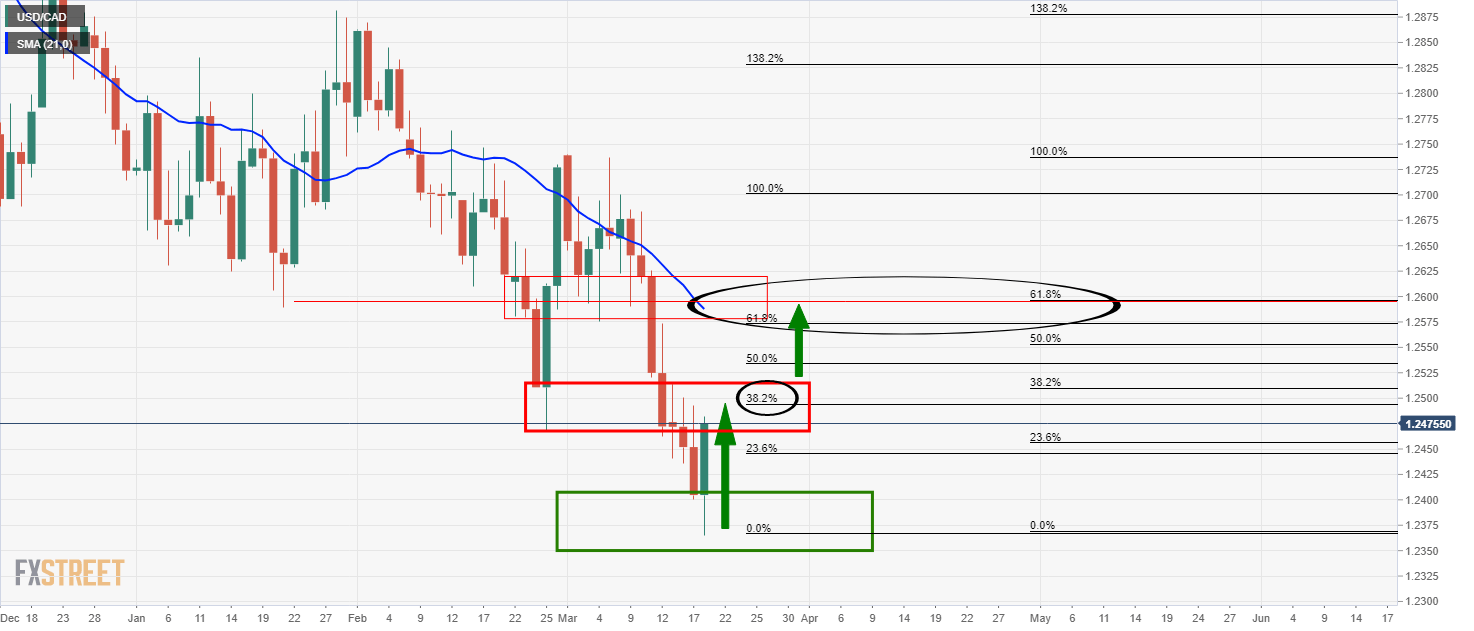

Daily chart

At least a 38.2% Fibonacci retracement can be expected on the daily chart.

A break there guards a fuller retracement to the 61.8% Fibo of the daily impulse if not to the weekly 61.8% Fibo which is slightly higher up and meets with the 21-day SMA.