AUD/USD Price Analysis: 21-DMA challenges bullish commitments, as 0.7700 beckons

- AUD/USD’s rebound from 100-DMA confronts key 21-DMA hurdle.

- Risk recovery lifts S&P 500 futures higher, triggers fresh USD selling.

- RSI still holds in the bearish region, what’s next for the aussie?

AUD/USD catches a fresh bid wave, reaching fresh 11-day highs near 0.7680, as the bulls continue their attempts towards 0.7700.

The latest leg higher in the major is mainly driven by the recovery in the risk sentiment, as the Asian stocks hover near record highs, tracking the uptick in the S&P 500 futures. The improved appetite for the riskier assets fuels renewed weakness in the safe-haven US dollar.

The US dollar tumbled with the Treasury yields on Tuesday after markets re-priced the Fed tightening bets that firmed up following Friday’s NFP blowout.

Next of relevance for the major remains the FOMC minutes while the RBA’s on-hold monetary policy decision announced on Tuesday had little to impact on the AUD markets.

AUD/USD: Technical outlook

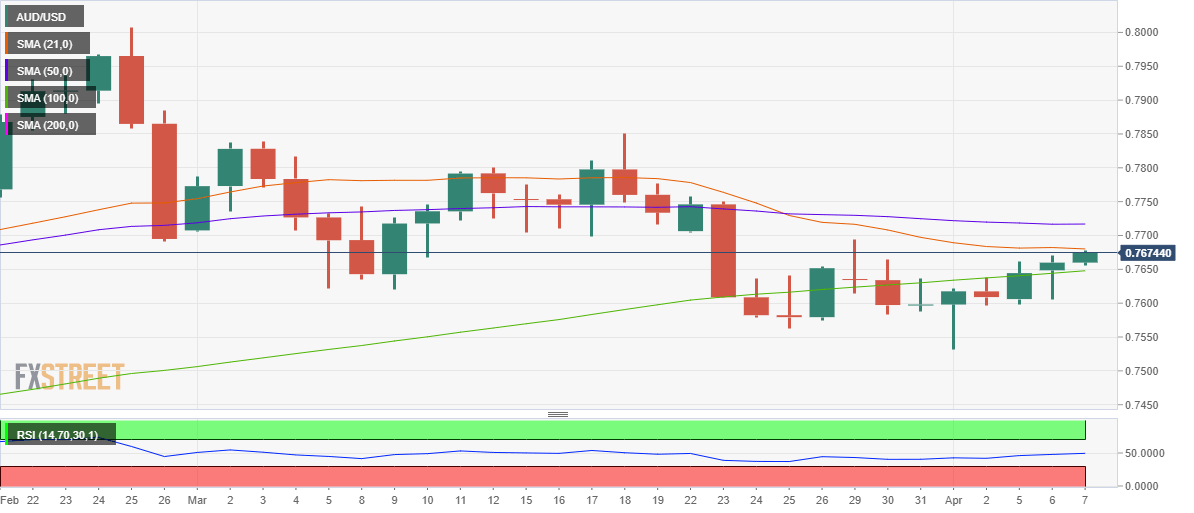

From a near-term technical perspective, the critical short-term 21-daily moving average (DMA) at 0.7680 offers immediate resistance, as the bulls continue aiming for the 0.7700 mark.

The horizontal 50-DMA resistance at 0.7717 is likely to be the next stop for the bulls should the abovementioned two barriers clear the way.

The Relative Strength Index (RSI) still holds in the bearish zone, now at 49.50, suggesting limited upside attempts for the aussie.

AUD/USD: Daily chart

Therefore, a failure to find acceptance above 21-DMA could negate the near-term bullish bias, calling for a test of the ascending 100-DMA at 0.7648.

Further south, Tuesday’s low of 0.7605 could come into play, opening floors towards the 0.7550 psychological level.

AUD/USD: Additional levels