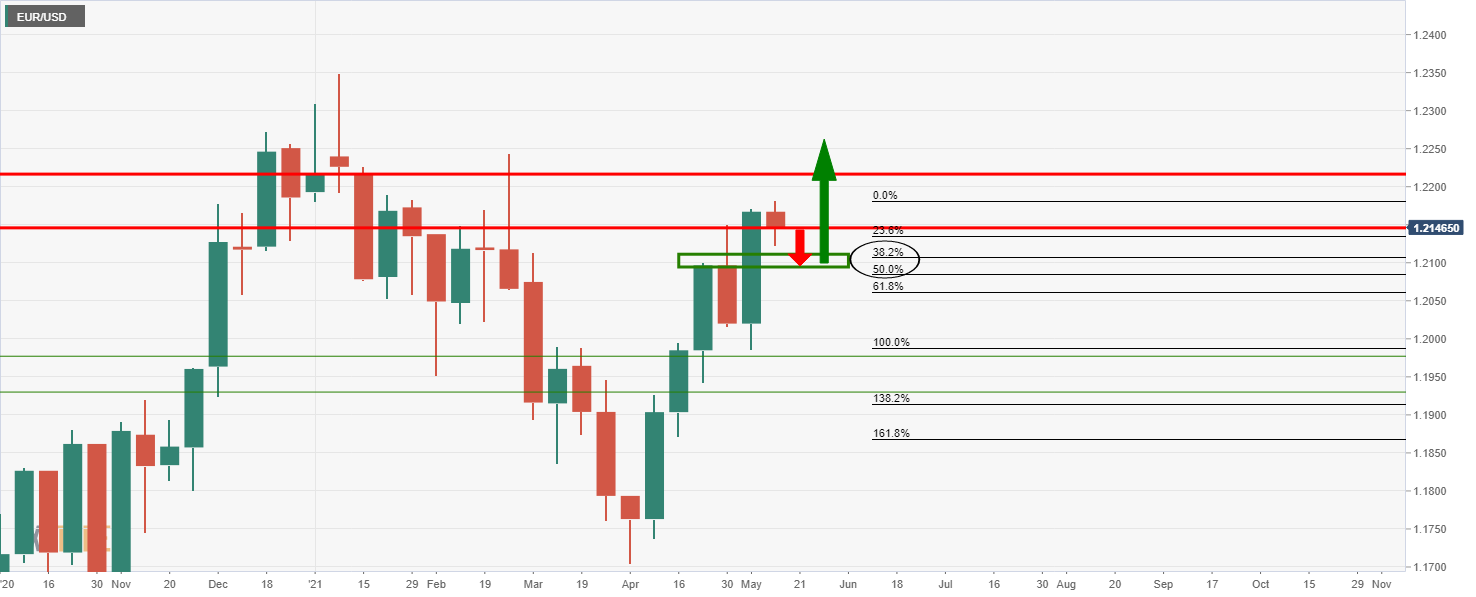

EUR/USD Price Analysis: Bears are lurking with eyes on 61.8% Fibo target

- EUR/USD struggles to convince on the upside and bears are lurking.

- A downside test of the 61.8% Fibo of the daily impulse could be on the cards.

EUR/USD is on the verge of a significant correction according to the following top-down analysis that illustrates the market structure and bearish bias across the monthly, weekly and daily time frames.

Monthly chart

The bulls need to clear the monthly resistance at this juncture or face an onslaught from the bears to test the support structure.

Weekly chart

The weekly chart is showing signs of upside exhaustion and would be expected to see the price to the 38.2% or the 50% mean-reversion targets.

Daily chart

The daily chart is showing a W-formation on the candles.

The rule of thumb is that the majority of such formations will see a restest of the prior highs of the pattern which will act as support prior to a bullish continuation.

In this case, the 61.8% Fibonacci is the key target.