Back

31 Jan 2022

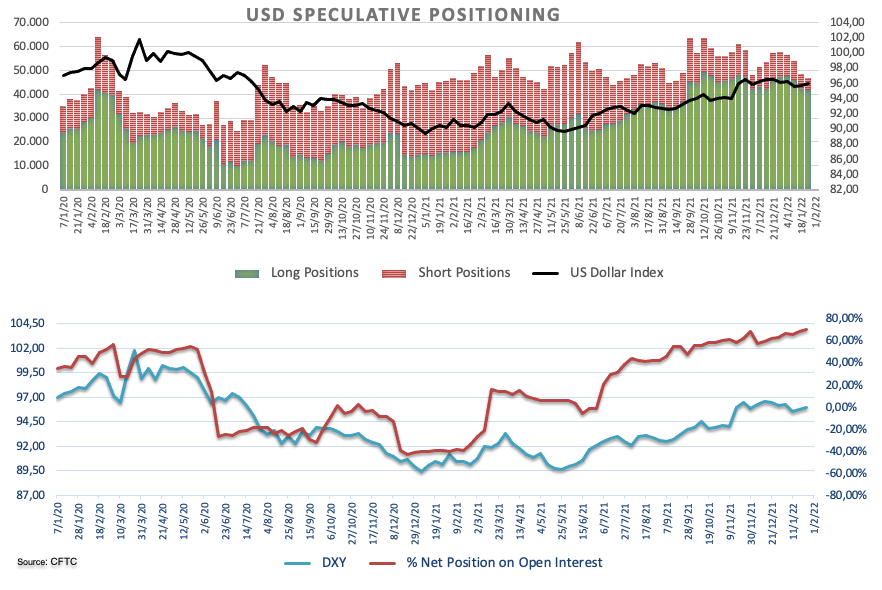

CFCT Positioning Report: USD net longs in 3-week highs

These are the main highlights of the CFTC Positioning Report for the week ended on January 25th:

- Speculators reduced both their long and shorts positions in USD, taking the net long position to a 3-week high. The greenback remained side-lined during the week under scrutiny amidst rising concerns surrounding the Russia-Ukraine front while Fed-speakers had already started to signal three or four interest rate hikes by the Federal Reserve this year.

- Gross longs in EUR went up for the sixth consecutive week, lifting the net longs to the highest level since mid-August 2021. Further rangebound in EUR/USD remained in place against the backdrop of alternating risk appetite trends amidst the rate cut by the PBoC, geopolitical effervescence and supportive comments for a sooner-than-expected Fed’s lift-off.

- Net shorts in the Japanese yen retreated to 3-week low following the combination of the corrective move in US yields and some geopolitics-induced risk aversion. That said, USD/JPY eased to as low as the mid-113.00s, where some decent contention turned up.

- The negative stance in the British pound remained well in place after net shorts rose to 2-week highs, as investors continued to fade the December-January rally on the back of domestic political turmoil and the unabated spread of the omicron pandemic.

- Net longs in the Russian ruble dropped to levels last seen in mid-June of last year, all amidst the increasing political effervescence as well as rising rumours of a potential military intervention in Ukraine, at the time when West powers continued to threaten with strong sanctions, both against Russian individuals and companies.