Back

8 Jul 2022

Crude Oil Futures: Further decline not ruled out

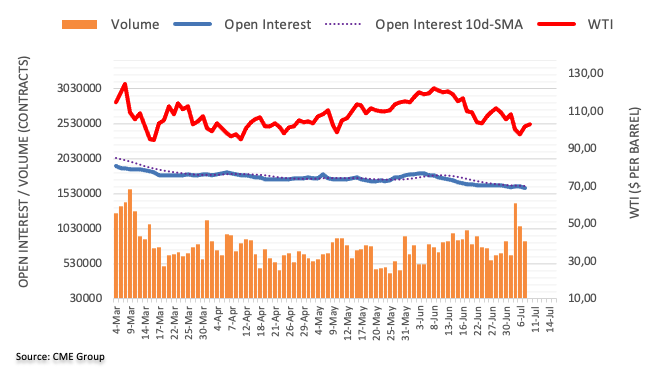

CME Group’s flash data for crude oil futures markets saw traders scale back their open interest positions by around 22.6K contracts on Thursday, clinching the second consecutive daily drop. Volume, in the same line, went down for the second day in a row, now by around 212.5K contracts.

WTI could revisit the 200-day SMA near $93.60

Prices of the WTI reversed part of the recent sharp pullback on Thursday. However, the move was on the back of diminishing open interest and volume, opening the door to the continuation of the downtrend to, initially, the 200-day SMA at $93.64.